State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

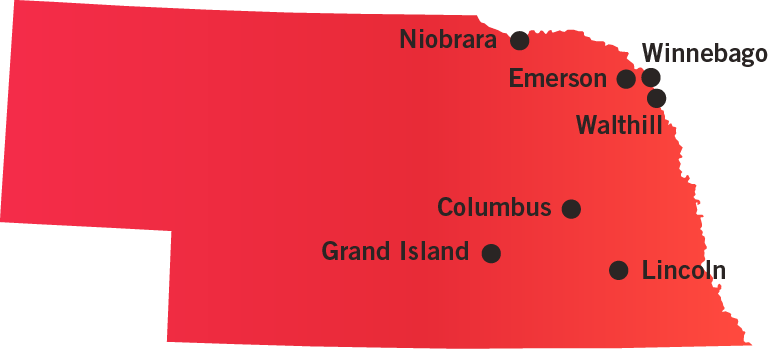

Number of Casinos 7

-

Economic Impact $487.4 Million

-

Jobs Supported 1,980

-

Tax Impact & Tribal Revenue Share $46.2 Million

-

Gross Gaming Revenue $89.1 Million (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

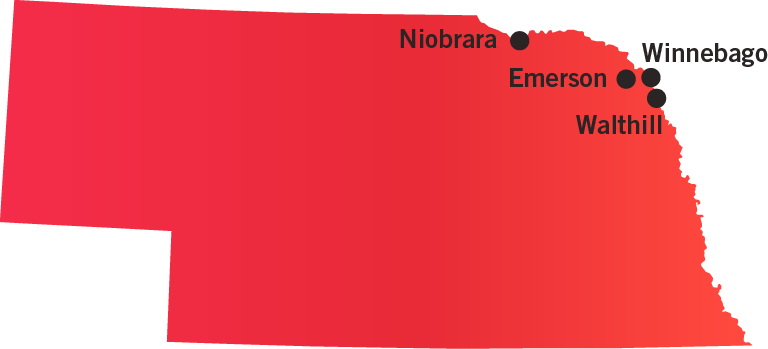

Number of Casinos 3

-

Economic Impact $447.5 Million

-

Jobs Supported 1,649

-

Tax Impact $40.5 Million

-

Gross Gaming Revenue $89.1 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 4

-

Economic Impact $39.9 Million

-

Jobs Supported 331

-

Tax Impact & Tribal Revenue Share $5.7 Million

-

Gross Gaming Revenue N/A

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Nebraska State Racing & Gaming Commission

5903 Walker Ave.

Lincoln, NE 68507

Tel: (402) 471-4155

The Nebraska State Racing & Gaming Commission is responsible for the oversight of gaming within the state. The Commission released their final draft casino gaming regulations in November 2021, while they released their final sports wagering regulations in October 2022 as part of their efforts to regulate and enforce legalized gaming within the state.

AVAILABLE GAMING LICENSES

Authorized Gaming Operator License

Gaming Facility License

For more information on available gaming licenses, see Regulatory Fact Sheet.

Tribes in Nebraska operate Class II gaming. For more information, click the Regulatory Fact Sheet button above.

TAX RATE

Initiative 431 establishes a 20 percent tax on all gross gaming revenue generated within licensed racetracks. Gross gaming revenue is defined as the amount of money players gamble minus the amount won, federal taxes, and any promotional gaming credits received from the operator and redeemed by the player.

TAX PROMOTIONAL CREDITS

In Nebraska, promotional credits may be deducted from the operator’s gross gaming revenue.

WITHHOLDINGS ON WINNINGS

Casinos winnings must be included on personal tax forms as taxable income, and withheld at a rate of 5 percent.

TAX ALLOCATION

Nebraska gaming tax revenue is distributed in the following manner:

- 70 percent to the state’s existing property tax relief fund;

- 2.5 percent to the state’s general fund;

- 2.5 percent to the state’s Compulsive Gamblers Assistance Fund; and

- 25 percent to the city or county where the racetrack is located.

Tribes in Nebraska operate Class II gaming. For more information, click the Regulatory Fact Sheet button above.

STATUTORY FUNDING REQUIREMENT

2.5 percent of total tax revenues.

SELF-EXCLUSION

Voluntary and may be added to the Self-Exclusion list for a period of (1) 1 year; (2) 18 months; (3) 5 years, or; (4) a lifetime.

COMPLIMENTARY ALCOHOLIC DRINKS

TBD. Regulations are forthcoming.

ADVERTISING RESTRICTIONS

Advertising must be approved by the Commission as part of operators’ general promotion and advertising plan.

ON-PREMISE DISPLAY REQUIREMENT

Operators are required as part of their Compulsive Gambling Assistance Plan to include printed materials to educate patrons, including signs and posters located inside licensed premises.

AGE RESTRICTIONS

21+ years of age to gamble

21+ of age on floor

Tribes in Nebraska operate Class II gaming. For more information, click the Regulatory Fact Sheet button above.

TESTING REQUIREMENTS

Must use accredited independent testing laboratory for evaluation

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Requires 5 business-day notice to the NRGC.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

TBD. Regulations are forthcoming.

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

Yes.

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrencies are not currently accepted as a form of payment for gambling transactions within Nebraska.

Tribes in Nebraska operate Class II gaming. For more information, click the Regulatory Fact Sheet button above.

AUTHORIZED OPERATORS

Licensed racetracks

MOBILE/ONLINE

No

TAX RATE

20 Percent

INITIAL LICENSING FEE

None

LICENSE RENEWAL FEE

None

AMATEUR RESTRICTIONS

Prohibited to offer wagers on in-state collegiate sports, events and athletes. In addition, operators may not offer wagers on individual athletes under 18 years of age.

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.