State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

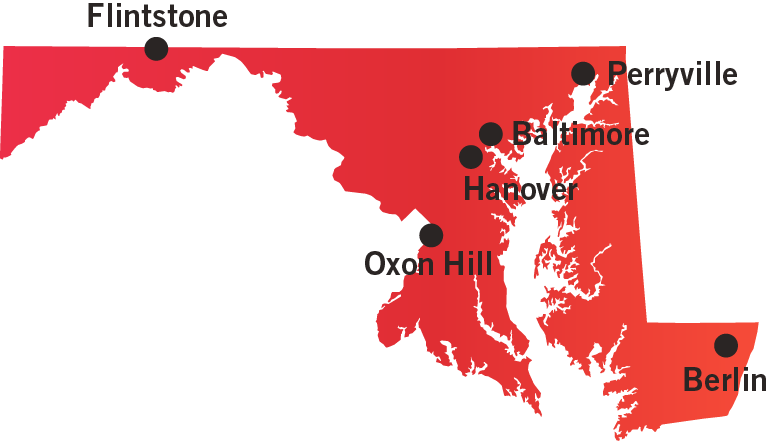

Number of Casinos 6

-

Economic Impact $5.78 Billion

-

Jobs Supported 27,380

-

Tax Impact $1.44 Billion

-

Gross Gaming Revenue $2.50 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Maryland Lottery and Gaming Control Commission

Montgomery Business Park

1800 Washington Blvd., Suite 330

Baltimore, MD 21230

410-230-8800

Website

Maryland Code State Government § 9-1A-01 et. seq., provides a regulatory framework for the implementation of Video Lottery Terminals (VLTs) and table games through the Maryland Lottery and Gaming Control Commission (MLGCC), within the Maryland Lottery and Gaming Control Agency (MLGCA).

The MLGCC is a seven-member board responsible for regulating gaming (slots and table games) in Maryland. The MLGCC also serves as an advisory board to the MLGCA.

After licenses are awarded, the MLGCA steps in for the subsequent regulatory process and is responsible for conducting background and financial checks of potential facility licensees, in conjunction with the appropriate agencies.

AVAILABLE GAMING LICENSES

Operator License

Manufacturer License

Distributor or Reseller License

For more information on available gaming licenses, see Regulatory Fact Sheet.

| SLOT MACHINE TAX RATE | |

| Maryland’s VLT tax rates vary by casino. Currently, owners of casinos are entitled to the following revenue shares from VLTs: | |

| Rocky Gap Casino Resort | 60% |

| Live! Casino & Hotel | 49% |

| Horseshoe Casino Baltimore | 46% |

| MGM National Harbor | 44% |

| Casino at Ocean Downs | 53% |

| Hollywood Casino Perryville | 39% |

TABLE GAME TAX RATE

20 percent

TAX PROMOTIONAL CREDITS

20 percent of total VLT from previous fiscal year may be used as tax free promotional play

WITHHOLDINGS ON WINNINGS

Winnings over $5,000: 8.75 percent for Maryland residents, 7 percent for out-of-state residents.

| SLOT MACHINE TAX ALLOCATION | |

| Education Trust Fund | 32.75-47.5% |

| Horse Racing Purse | 6% |

| Local Impact Grants | 5.5% |

| Race Track Facilities Renewal Account | 1% |

| Maryland Lottery & Gaming Control Agency | 1% |

| Small, minority and women-owned business | 1.5% |

TABLE GAME TAX ALLOCATION

15 percent to the Maryland’s Education Trust Fund and 5 percent to local grants.

STATUTORY FUNDING REQUIREMENT

An annual fee of $425 is required to be paid for each video lottery terminal and $500 for each table game operated by a licensee during any given year.

SELF-EXCLUSION

Yes. Minimum of two years

COMPLIMENTARY ALCOHOLIC DRINKS

No

ADVERTISING RESTRICTIONS

It is illegal for a gaming advertisement to be false or deceptive, or knowingly direct a gaming advertisement to an individual under 21 years of age or to persons on the state’s exclusion (mandatory or voluntary) lists. All gaming advertisements must bear the approved gambling assistance message.

ON-PREMISE DISPLAY REQUIREMENT

The state’s approved gambling assistance message must be displayed at each customer entrance to the gaming floor.

AGE RESTRICTIONS

21+ years age to gamble

21+ years age on floor

TESTING REQUIREMENTS

Lottery Commission must approve VLTs and table games.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Must submit written notice to Lottery Commission prior to transport.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

A person with an interest in a video lottery facility may not make political contributions in state elections.

CREDIT OFFERED TO PATRONS

The Lottery Commission may extend credit to players for the purpose of gaming.

SMOKING BANS

Yes

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Additionally, cryptocurrency is not currently permitted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

A1 and A2 licenses: Commercial casinos, racetracks, sports arenas, online operators

B1 and B2 licenses: State Fairgrounds, OTB’s, and commercial bingo facilities permitted to operate at least 200 electronic bingo machines or electronic tip jar machines

MOBILE/ONLINE

Mobile allowed statewide.

TAX RATE

15 percent

INITIAL LICENSING FEE

$2 Million for Class A-1 Sports Wagering Facility License–Retail wagering at casinos having more than 1,000 VLTs and the owner (or designee) of professional major league sports franchises or stadiums.

$1 Million for Class A-2 Sports Wagering Facility License–Retail wagering at casinos having 1,000 or fewer VLTs and horse racetracks.

$250,000 for Class-B-1 Sports Wagering Facility License–Retail wagering at businesses having 25 or more FTE employees or earning $3 million or more in annual gross receipts.

$50,000 for Class B-2 Sports Wagering Facility License-Retail at businesses having less than 25 FTE employees or earning less than $3 million in annual gross receipts.

$500,000 for Mobile Sports Wagering License

LICENSE RENEWAL FEE

One percent of the licensee’s average annual proceeds for the preceding 3-year period, less any proceeds remitted for taxes.

AMATEUR RESTRICTIONS

Wagering on high-school sporting events is prohibited.

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.