State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

Number of Casinos 35

-

Economic Impact $4.16 Billion

-

Jobs Supported 19,129

-

Tax Impact & Tribal Revenue Share $597.9 Million

-

Gross Gaming Revenue $1.48 billion (2023 Commercial)

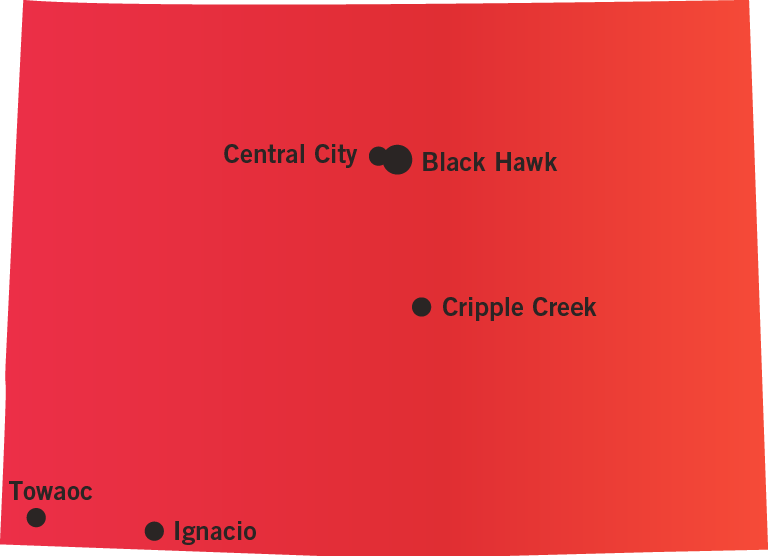

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2024.

-

Number of Casinos 33

-

Economic Impact $3.91 Billion

-

Jobs Supported 17,292

-

Tax Impact $562.8 Million

-

Gross Gaming Revenue $1.48 billion (2023)

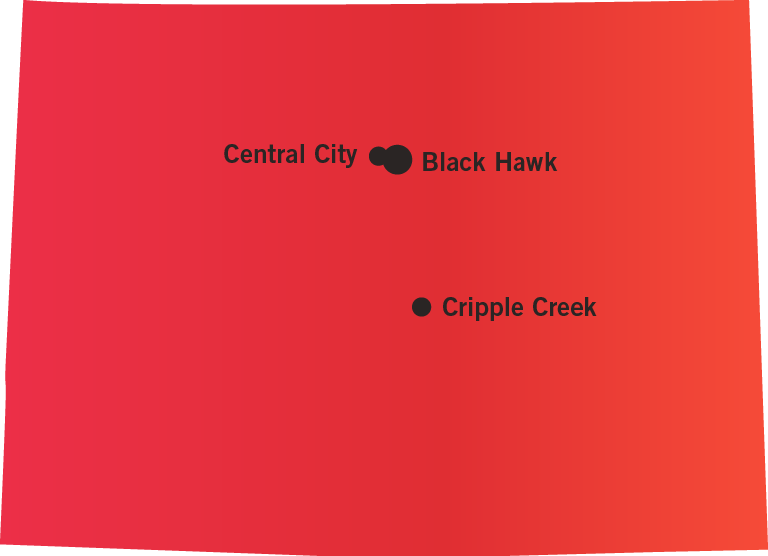

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 2

-

Economic Impact $250.1 Million

-

Jobs Supported 1,837

-

Tax Impact & Tribal Revenue Share $35.2 Million

-

Gross Gaming Revenue N/A

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Colorado Department of Revenue, Division of Gaming

1707 Cole Blvd., Suite 300

Lakewood, CO 80401

Phone: 303-205-1300

Colorado Revised Statutes creates the Division of Gaming within the Department of Revenue. The division is responsible for the regulation and enforcement of limited gaming in Colorado. Among the duties of the Division of Gaming is the investigation of gaming license applicants.

Division investigators also patrol casinos during all hours of operation to ensure proper compliance with gaming laws, rules, and regulations.

AVAILABLE GAMING LICENSES

Operator License

Retail Gaming License

Slot Machine Manufacturer or Distributor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

The Ute Mountain Ute Tribe and the Southern Ute Indian Tribe are the only two tribes in the state of Colorado authorized to conduct Class III gaming.

The Ute Mountain Ute Gaming Commission and the Southern Ute Tribal Gaming Agency is responsible for the on-site regulation, control and security of all Class III gaming for their respective tribes.

At the state level, the Colorado Limited Gaming Control Commission and the Colorado Division of Gaming monitors the tribal gaming of both tribes in order to ensure tribal gaming operations are being conducted in accordance with the compact.

The compacts grant both tribes the authority to enter into a management contract for the operation and management of a casino.

The size of the gaming facilities and the number of gaming devices in each facility shall be determined by the tribe.

AVAILABLE GAMING LICENSES

Facility License

Operator License

Manufacturer/Distributor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

| GAMING TAX RATE | |

| The tax rates for FY2014, the highest allowed under Amendment 50, are as follows: | |

| Adjusted Gross Proceeds | Graduated Tax Rate |

| $0 – $2m | 0.25% |

| $2m – $5m | 2% |

| $5m – $8m | 9% |

| $8m – $10m | 11% |

| $10m – $13m | 16% |

| Over $13m | 20% |

TAX PROMOTIONAL CREDITS

Effective January 1, 2023 and from that date through June 30, 2024, no more than 2.5 percent of the total amount of free bets can be deducted, declining to 2.4 percent on July 1, 2024, then 2 percent on July 1, 2025, prior to capping deductions at 1.75 percent on July 1, 2026.

WITHHOLDINGS ON WINNINGS

Gambling winnings are considered taxable income and withheld at a flat 24 percent rate.

TAX ALLOCATION

Taxes in the state are distributed in the following manner:

• 28 percent to the State Historical Society;

• 12 percent to Gilpin and Taller counties;

• 10 percent to Blackhawk, Central City and Cripple Creek; and

• 50 percent to the State General Fund.

TAX RATE

There is no revenue-sharing provision in exchange for limited or total exclusivity in either of the compacts.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

Yes

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

Two percent of total revenues

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

Licensees are prohibited from allowing, conducting, or participating in any false or misleading advertising concerning its limited gaming operations.

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

21+ years of age to gamble

21+ of age on floor

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

Must be 21 years of age.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

Conducted by the Field Operations Unit and Technical Systems Group of the Division of Gaming

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements

SHIPPING REQUIREMENTS

The Division of Gaming must be notified of all shipments of gaming equipment.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

Yes

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Patrons are also permitted to deposit cryptocurrency.

TESTING REQUIREMENTS

Prior to the installation and use of a slot machine, progressive slot machine or keno equipment, the tribal gaming commission must inspect and test the device for approval.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act apply.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

All payment for wagers must be made by cash, check or traveler’s check. The tribal casinos may not extend credit.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes

AUTHORIZED OPERATORS

Legislation enacted in 2019 authorizes the state’s 33 licensed casinos to obtain a master license to offer sports betting at their casinos and via an online website or mobile application.

Additionally, the Ute Mountain Ute Tribe and Southern Ute Indian Tribe are permitted to offer sports betting under the terms of their tribal-state gaming compacts.

MOBILE/ONLINE

Mobile allowed statewide.

TAX RATE

Sports-betting revenue is taxed at a rate of 10 percent. However, operators are permitted to deduct free bets up to a certain percentage, payments to players, as well as the 0.25 percent federal excise tax on sports bets, effectively lowering the taxation rate.

INITIAL LICENSING FEE

$2,000

LICENSE RENEWAL FEE

$2,000 every two years.

AMATEUR RESTRICTIONS

High-school sporting events or, only with respect to proposition bets, collegiate sporting events.

TAX ON PROMOTIONAL CREDITS

Promotional credits are taxed as net sports betting proceeds at the rate of 10 percent. However, operators are permitted to deduct a percentage of free bets as follows:

- From January 1, 2023 to June 30, 2024, no more than 2.5 percent of the total amount of free bets can be deducted.

- From July 1, 2024 to June 30, 2025, no more than 2.4 percent of the total amount of free bets can be deducted.

- From July 1, 2025 to June 30, 2026, no more than 2 percent of the total amount of free bets can be deducted.

- From July 1, 2026, no more than 1.75 percent of the total amount of free bets can be deducted.

AGE RESTRICTIONS

Must be 21 years of age.