State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

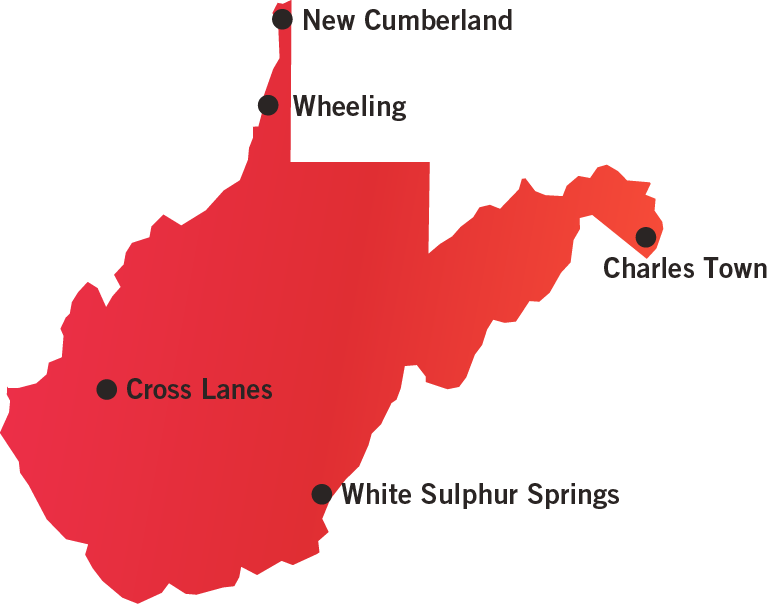

Number of Casinos 5

-

Economic Impact 1.88 Billion

-

Jobs Supported 10,663

-

Tax Impact $474.2 Million

-

Gross Gaming Revenue $805.9 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

West Virginia Lottery

900 Pennsylvania Avenue

Charleston, WV 25302

304-558-0500

Website

The state lottery oversees casino-style gaming in West Virginia. Section 29-22-4 of the West Virginia Code creates a seven-member lottery commission. The governor, with the advice and consent of the state Senate, appoints members of the commission. Section 29-22-5 outlines the powers and duties of the state lottery commission. The Racetrack Video Lottery Act, West Virginia Code Section 29-22A, authorizes the operation of video lottery terminals (VLTs) at racetracks under the regulation and control of the state lottery.

Local approval via a referendum is required before the state’s racetracks can operate VLTs. A licensed racetrack has the right to install and operate up to 400 VLTs and may apply for the right to operate more.

AVAILABLE GAMING LICENSES

Racetrack Video Lottery Operator License

Racetrack Table Games Operator License

Gaming Facility License

VLT Manufacturer License

Table Game Supplier License

Interactive Wagering License Interactive Wagering Supplier

Interactive Gaming Provider/Management Services Provider

GAMING TAX RATE

53.5 percent on gaming machine revenue

35 percent on table game revenue

TAX PROMOTIONAL CREDITS

The state allows operators to issue 2-3 percent of promotional credits tax free, subject to a quarterly review.

WITHHOLDINGS ON WINNINGS

West Virginia does not withhold gambling taxes for state purposes, but must collect 6.5 percent if the winner does not provide proper identification.

| TAX ALLOCATION | |

| The Lottery Commission first pays for its operating costs, which are capped at four percent of the gross terminal income. The net terminal income collected by the state is distributed in the following manner: | |

| Lottery Commission | 30% |

| Racing Purses | 7% |

| Workers Compensation Debt Reduction Fund | 7% |

| Tourism Fund | 3% |

| Host Counties | 2% |

| Thoroughbred Development Fund | 1.5% |

| Racetrack Employee Pension | 1% |

| Racing Commission | 1% |

| Other | 1% |

| Returned to Licensee | 46.5% |

STATUTORY FUNDING REQUIREMENT

Between $150,000 and $500,000.

SELF-EXCLUSION

Yes

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

Yes

AGE RESTRICTIONS

21+ years of age to gamble or be on the floor.

TESTING REQUIREMENTS

Must be approved by the Lottery Commission and approved by an independent testing laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Lottery Commission requires notice prior to transportation of Video Lottery Terminals (VLTs).

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

No (for video lottery games)

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

Commercial casinos, racinos & online operators

MOBILE/ONLINE

Allowed statewide

TAX RATE

10 percent

INITIAL LICENSING FEE

$100,000

LICENSE RENEWAL FEE

$100,000, payable every 5 years

AMATEUR RESTRICTIONS

None

TAX OF PROMOTIONAL CREDITS

Yes

AGE RESTRICTIONS

Must be 21 years old.