Sizing the Illegal and Unregulated Gaming Markets in the U.S.

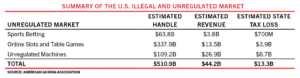

AGA’s report estimates that Americans bet more than $510.9 billion a year with illegal and unregulated operators. This costs the legal industry $44.2 billion in gaming revenue and state governments $13.3 billion in lost tax revenue.

The legal gaming industry is among the most highly regulated industries in America. Whether it is financial solvency and other licensing requirements, know your customer or anti-money laundering regulations, legal gaming operators and suppliers comply with thousands of laws and regulations designed to ensure consumer protections and confidence in the gaming market.

Illegal and unregulated gambling operators do not follow any of these standards, which exposes consumers to severe risk and undermines the economic and tax contributions of the legal gaming industry. Unlike legal operators, illegal operators also don’t pay a dime in taxes.

AGA’s report, Sizing the Illegal and Unregulated Gaming Markets in the U.S., estimates that Americans bet more than $510.9 billion a year with illegal and unregulated operators. This costs the legal industry $44.2 billion in gaming revenue and state governments $13.3 billion in lost tax revenue.

Sports Betting Findings

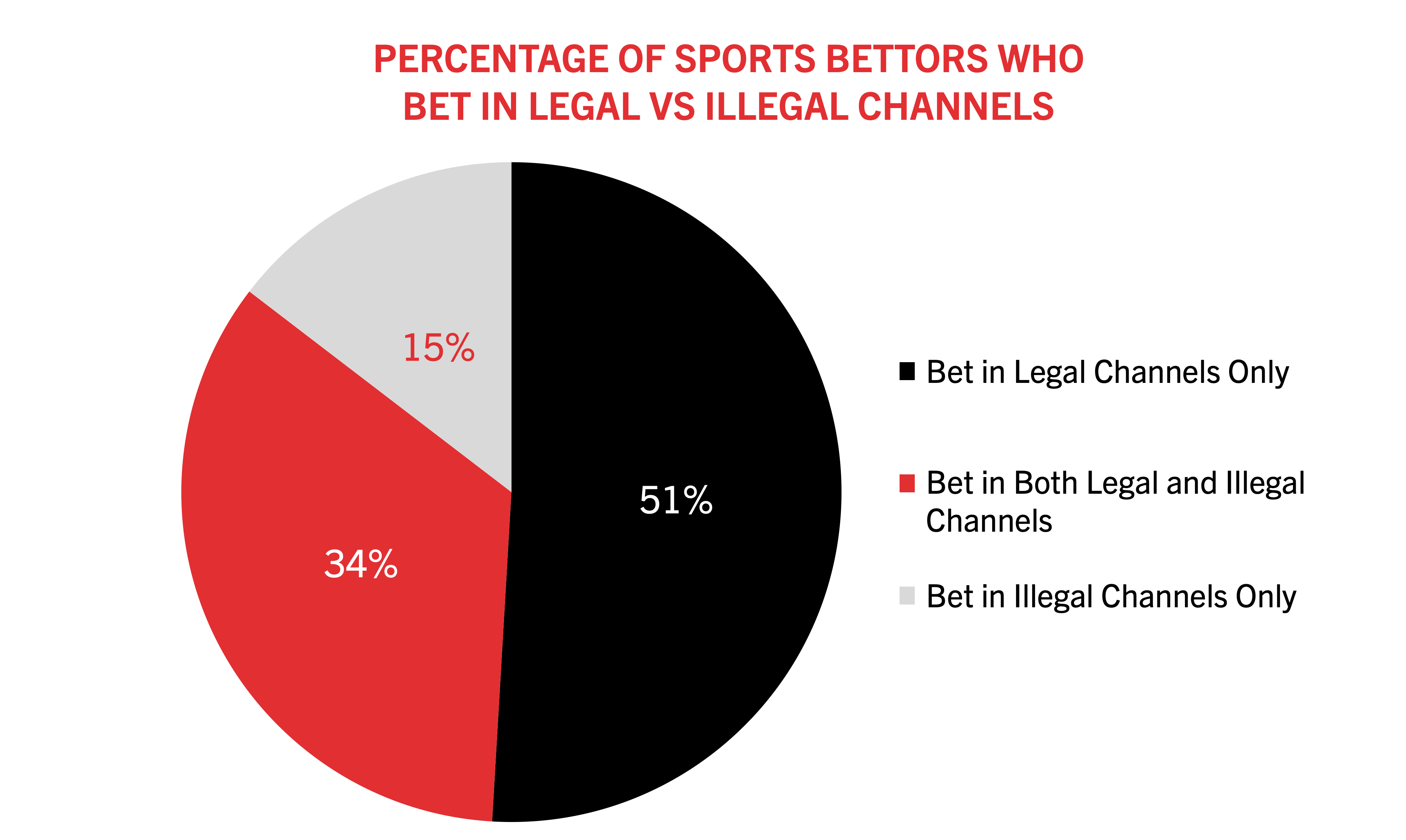

AGA’s report estimates that Americans wager $63.8 billion with illegal bookies and offshore sites at a cost of $3.8 billion in gaming revenue and $700 million in state taxes. With Americans projected to place $100 billion in legal sports bets this year, these findings imply that illegal sportsbook operators are capturing nearly 40 percent of the U.S. sports betting market.

The report also finds that 49 percent of past-year sports bettors have placed a bet with an illegal operator. Previous AGA research shows that more than half of Americans that bet on sports with illegal operators believe they are wagering legally.

iGaming Findings

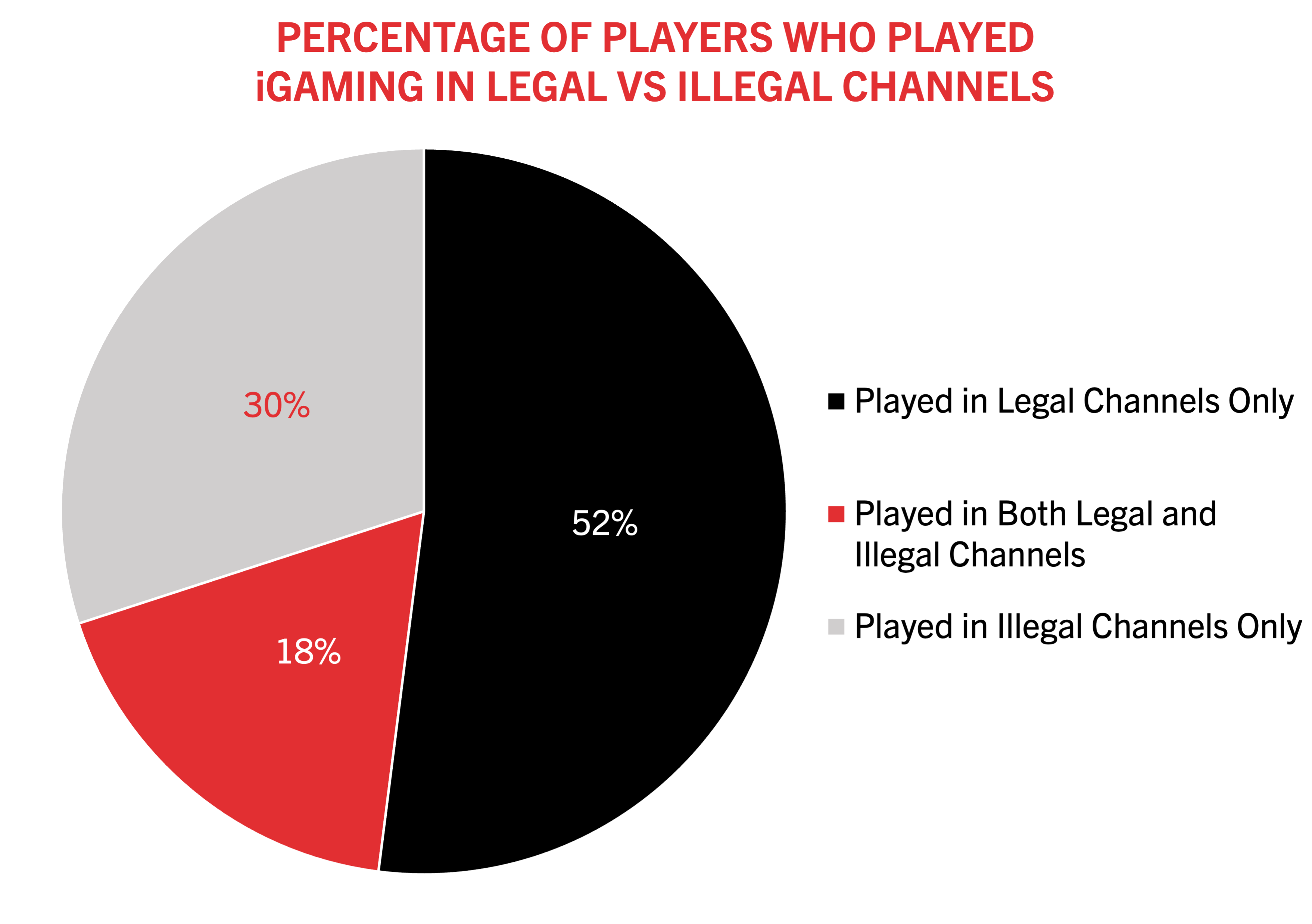

Americans wager an estimated $337.9 billion with illegal iGaming websites, with a loss of $3.9 billion in state tax revenue. With $13.5 billion in estimated revenue, the illegal iGaming market in the U.S. is nearly three times the size of the legal U.S. iGaming market, estimated to be $5 billion in 2022.

With iGaming only legal in six states, nearly half of Americans (48%) that have played online slots or table games in the past year have played with illegal online casinos.

Unregulated and “Skill Machine” Findings

Unregulated gaming machines, including so-called “skill machines,” also continue to proliferate, with an estimated 580,651 unregulated machines in the U.S. With 870,000 regulated machines in casinos and slot routes, that means 40% of all gaming machines in the U.S. are unlicensed.

Based on state regulatory data for similar machines, the operator win percentage on unregulated gambling machines is significantly higher than legal casino slot machines. During the past 12 months, slot machines in Nevada have a 7.16 percent win rate, compared to a nearly 25 percent estimated win rate for unregulated machines—demonstrating how unregulated machines take advantage of customers.

“All stakeholders—policymakers, law enforcement, regulators, legal businesses—must work together to root out the illegal and unregulated gambling market. This is a fight we’re in for the long haul to protect consumers, support communities and defend the law-abiding members of our industry.” - AGA President and CEO Bill Miller

Methodology

The study was conducted by The Innovation Group on behalf of the American Gaming Association and is based largely on a survey of 5,284 U.S adults, examining their past-year gambling behaviors with both legal and illegal operators as well as their observations of unregulated gaming machines. It also incorporates publicly available data on the size of the legal U.S. gaming market and certain state gaming machine markets.