State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

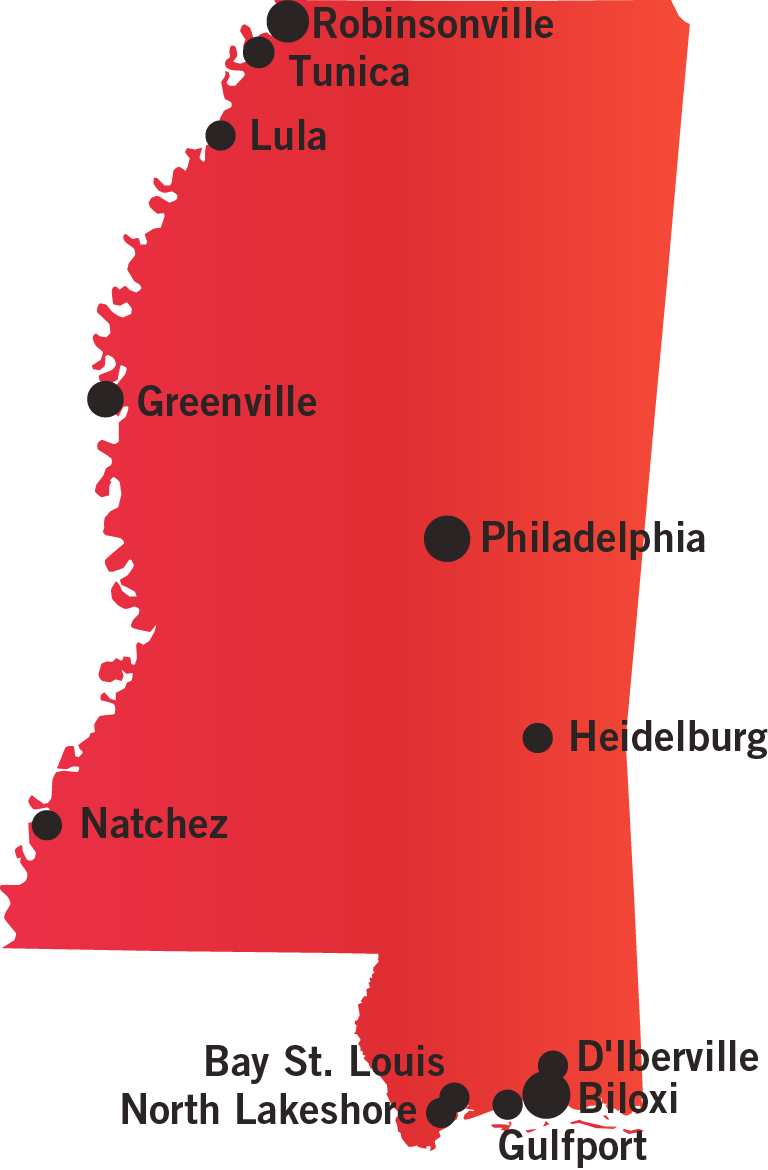

Number of Casinos 29

-

Economic Impact $6.54 Billion

-

Jobs Supported 41,950

-

Tax Impact & Tribal Revenue Share $876.7 Million

-

Gross Gaming Revenue $2.48 Billion (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

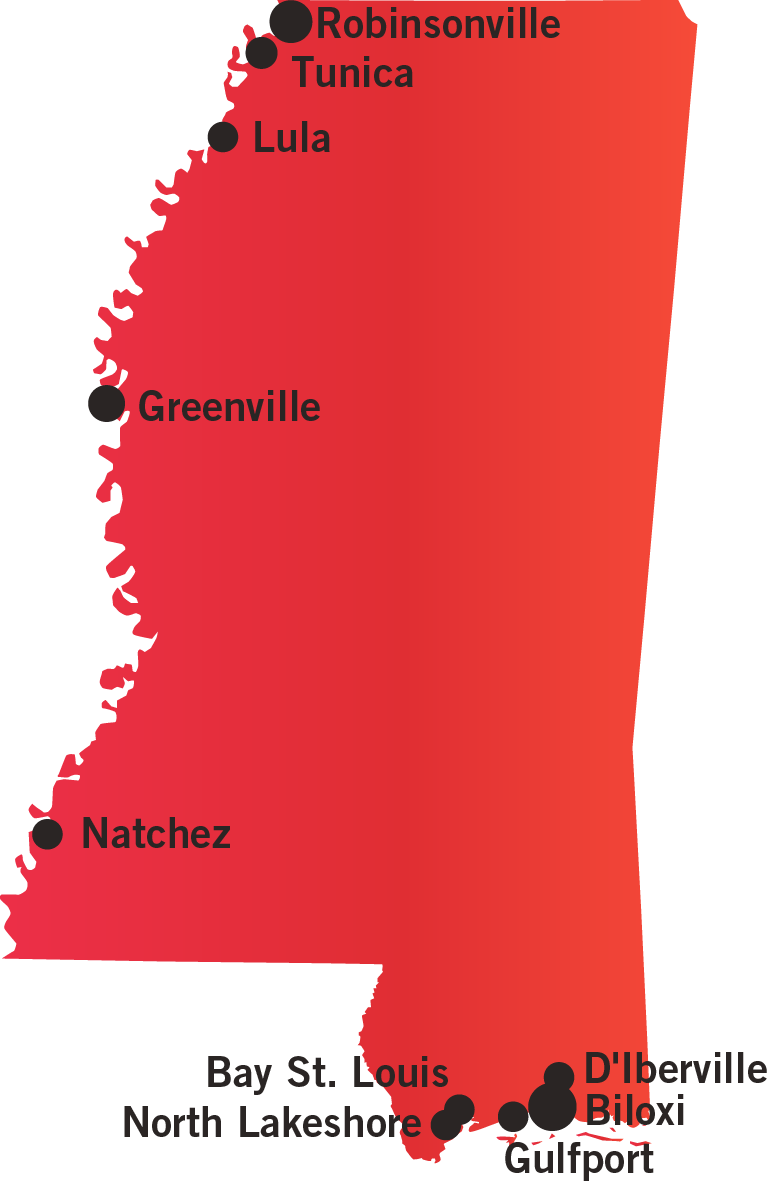

Number of Casinos 26

-

Economic Impact $5.34 Billion

-

Jobs Supported 33,063

-

Tax Impact $763.6 Million

-

Gross Gaming Revenue $2.48 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 3

-

Economic Impact $1.21 Billion

-

Jobs Supported 8,887

-

Tax Impact & Tribal Revenue Share $113.1 Million

-

Gross Gaming Revenue N/A

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Mississippi Gaming Commission

MGC Headquarters

620 North Street, Suite 200

Jackson, MS 39202

601-576-3800

Website

Section 75-76-7 of the Mississippi Code of 1972 established and outlined the structure of the Mississippi Gaming Commission (MGC). The MGC is responsible for the licensing, supervision, control, and regulation of the commercial gaming and charitable gaming industries. The MGC is divided into divisions with varying responsibilities — a list of the divisions can be found here.

AVAILABLE GAMING LICENSES

Casino Operator License

Manufacturer License

Distributor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

The Mississippi Band of Choctaw Indians is the only tribe in the state of Mississippi authorized to offer Class III gaming. As per the tribal state compact, the Choctaw Gaming Commission is responsible for oversight of tribal casinos in the state. The compact gives the Mississippi Gaming Commission limited regulatory authority over tribal gaming to ensure compliance with compact provisions. The Tribe and a contractor who has been licensed pursuant to Section 8 of the compact may enter into a management contract for the operation and management of a casino.

The compact shall remain in full force and effect until terminated by mutual consent of all parties.

AVAILABLE GAMING LICENSES

Manufacturer License

For more information on available gaming licenses, see Regulatory Fact Sheet.

| STATE TAX RATE | |

| The state tax levied on each gaming licensee is paid in the form of an additional license fee based upon the gross gaming revenues as follows: | |

| Gross Gaming Revenue | Graduated Tax Rate |

| $0 – $50,000 | 4% |

| $50,000 – $134,000 | 6% |

| Over $134,000 | 8% |

LOCAL TAX RATE

In addition, each of the local Mississippi municipalities that host commercial casinos charge an additional annual license fee at an average rate of 3–4 percent of gaming revenue.

TAX PROMOTIONAL CREDITS

Only taxed if the promotional credits have a cash value.

WITHHOLDINGS ON WINNINGS

Three percent when a W2G is given to a patron at a casino.

TAX ALLOCATION

A majority of state casino gaming tax revenue is directed to Mississippi’s General Revenue Fund, with monthly amounts of $3m distributed to a separate state highway construction fund.

REVENUE SHARE

The tribe and the state must separately provide $250,000 annually in matching funds to be used for advertising and promotion of tourism.

TAX PROMOTIONAL CREDITS

Promotional credits are only taxed if they have a cash value.

WITHHOLDINGS ON WINNINGS

Three percent when a W2G is given to a patron at a casino.

STATE USE OF REVENUE

The state uses revenue from tribal gaming for advertising and promotion of tourism.

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

Subject to annual appropriation

SELF-EXCLUSION

Minimum of 5 years up to his or her entire lifetime

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

Casino licensees can be disciplined if they fail to conduct advertising and public relations activities in accordance with decency and dignity.

ON-PREMISE DISPLAY REQUIREMENT

Casinos must post in conspicuous places written materials.

AGE RESTRICTIONS

21+ years of age to gamble

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

Yes

COMPLIMENTARY ALCOHOLIC DRINKS

The tribe is permitted to offer free alcohol, however, not all casinos do.

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

No person under the age of 21 shall be permitted to play any Class III game.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

Needs approval from Executive Director of MGC.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Requires express written authorization from the MGC.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

Regulations outline minimum acceptable credit procedures.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Cashless gaming is permitted. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

TESTING REQUIREMENTS

All slot games of chance must be tested, approved or certified by a gaming test laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

Yes

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

The compact does not address cashless gaming or alternative payments. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

Commercial and tribal casinos

MOBILE/ONLINE

Allowed on-premise only

TAX RATE

8 percent state tax, 3-4 percent local tax

INITIAL LICENSING FEE

None

LICENSE RENEWAL FEE

None

AMATEUR RESTRICTIONS

Collegiate prop betting where one athlete determines the outcome

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.