State of the States 2021

The definitive study of the U.S. commerical gaming industry in 2020, providing key financial performance data and other metrics for the 29 states and D.C. with commercial gaming operations.

State of the States 2021

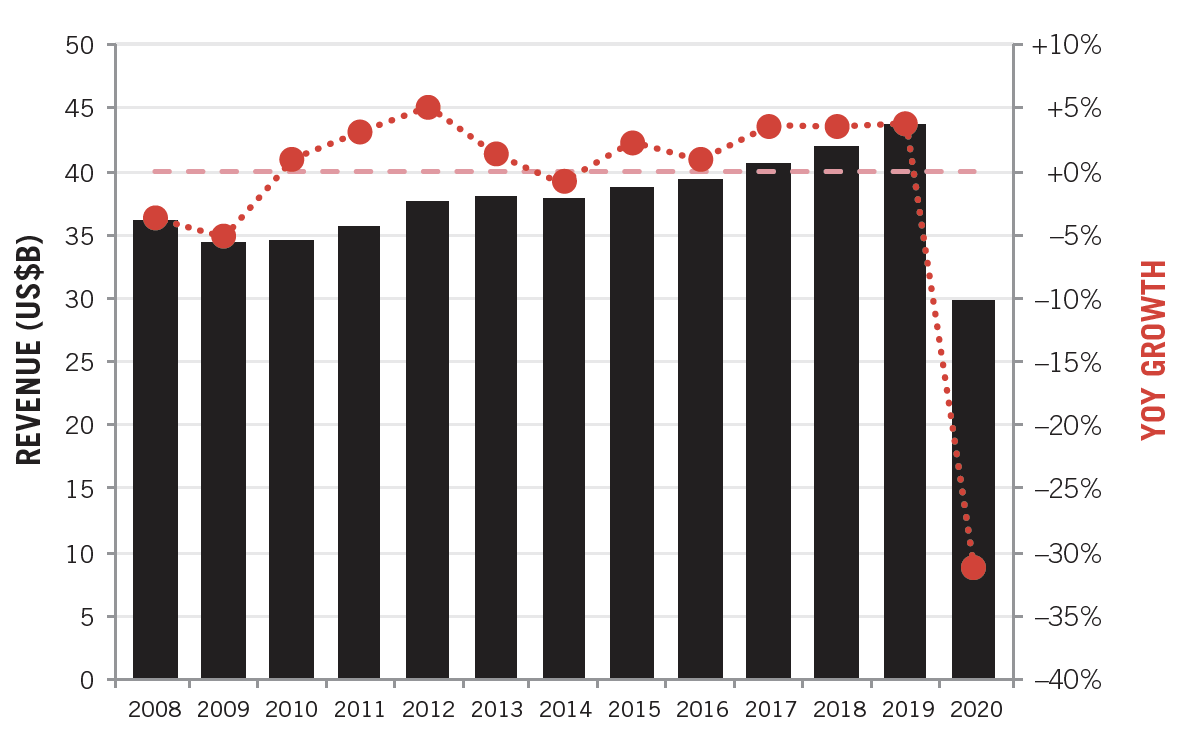

The COVID-19 pandemic had a dramatic impact on the gaming industry in 2020, causing U.S. commercial casino gaming industry revenue to drop 31.3 percent from 2019 to $30.0 billion, according to the American Gaming Association’s State of the States report.

$30.0 billion generated in commercial gaming revenue in 2020 - the first market contraction since 2014 and the lowest total since 2003

45,600 lost business days for commercial casinos due to pandemic-related closures, or approximately 27% of potential operating days.

$6.7 billion paid in gaming taxes to state and local governments, with billions more supported in sales, income and other taxes

Annual U.S. Commercial Gaming Revenue

In 2020, all 25 states with physical commercial casino gaming reported lower revenue than in 2019, but the size of their declines varied sharply and closely tracked with the length of mandated casino closures and the severity of COVID-19 restrictions once casinos were allowed to reopen. New Mexico experienced the steepest decline, as casinos closed in mid-March and remained shuttered the rest of the year, while South Dakota reopened after just a seven-week shutdown and saw a relatively modest revenue decline.

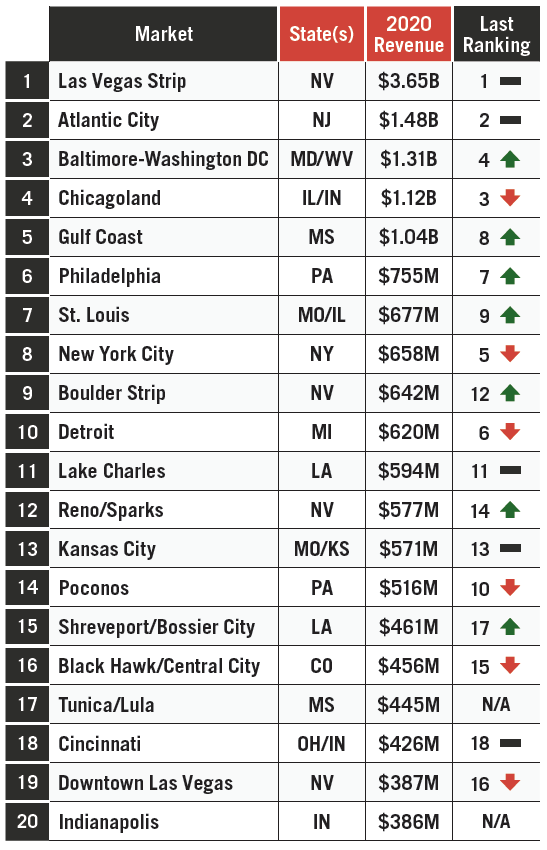

The disruption wrought by the pandemic also caused a significant shakeup in the top 20 casino markets by total gaming revenue. The Baltimore-Washington, D.C. gaming market is now the third largest in the country, passing Chicagoland, with the Gulf Coast, St. Louis and Shreveport/Bossier City markets also jumping several spots in the top 20 rankings.

Top 20 Gaming Markets

*Market revenue encompass electronic gaming devices and table games but not sports betting or internet gaming.

Americans continued to voice their support for the gaming industry in 2020, as voters in six states approved gaming expansion referendums in November

While COVID-19 overwhelmed traditional gaming sectors due to government-mandated closures and amenity restrictions, the industry experienced monumental growth in emerging verticals like sports betting and iGaming.

Despite widespread sportsbook shutdowns and an abbreviated sports calendar in 2020, the launch of seven new legal sports betting markets and the continued maturation of existing legal sports betting markets boosted 2020 national sports betting revenue by 69 percent year-over-year to nearly $1.6 billion. iGaming also generated nearly $1.6 billion in revenue across the four markets that were operational in 2020 (excluding Nevada online poker), tripling 2019’s revenue total.

“The gaming industry faced enormous challenges in 2020 – and we also saw significant changes, as player demographics shifted and emerging verticals saw strong growth. From sharp revenue declines, to booming legal sports betting activity and overwhelming voter enthusiasm behind gaming, this year’s report reflects both the highs and lows of the past year.” - AGA President and CEO Bill Miller.

About the Report

State of the States 2021 is the definitive economic analysis of the U.S. commercial casino industry and its significant economic impact in the 29 states and the District of Columbia with commercial gaming operations. For each of the 30 jurisdictions, the report analyzes gaming revenue and gaming taxes generated by commercial casino locations for the calendar year 2020. The report, developed with VIXIO GamblingCompliance, also provides a breakdown of the legality of types of gaming and number of casinos by state, summarizes major gaming policy discussions, and previews opportunities and challenges for the industry. The companion State of Play map provides the report findings in an easy-to-use, interactive tool.

Note, tribal casinos are subject to different reporting requirements and timelines. According to the most recently available data from the National Indian Gaming Commission, the tribal gaming sector’s revenue reached $34.6 billion in 2019.

Photo Credit: © Chon Kit Leong / Alamy Stock Photo