State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

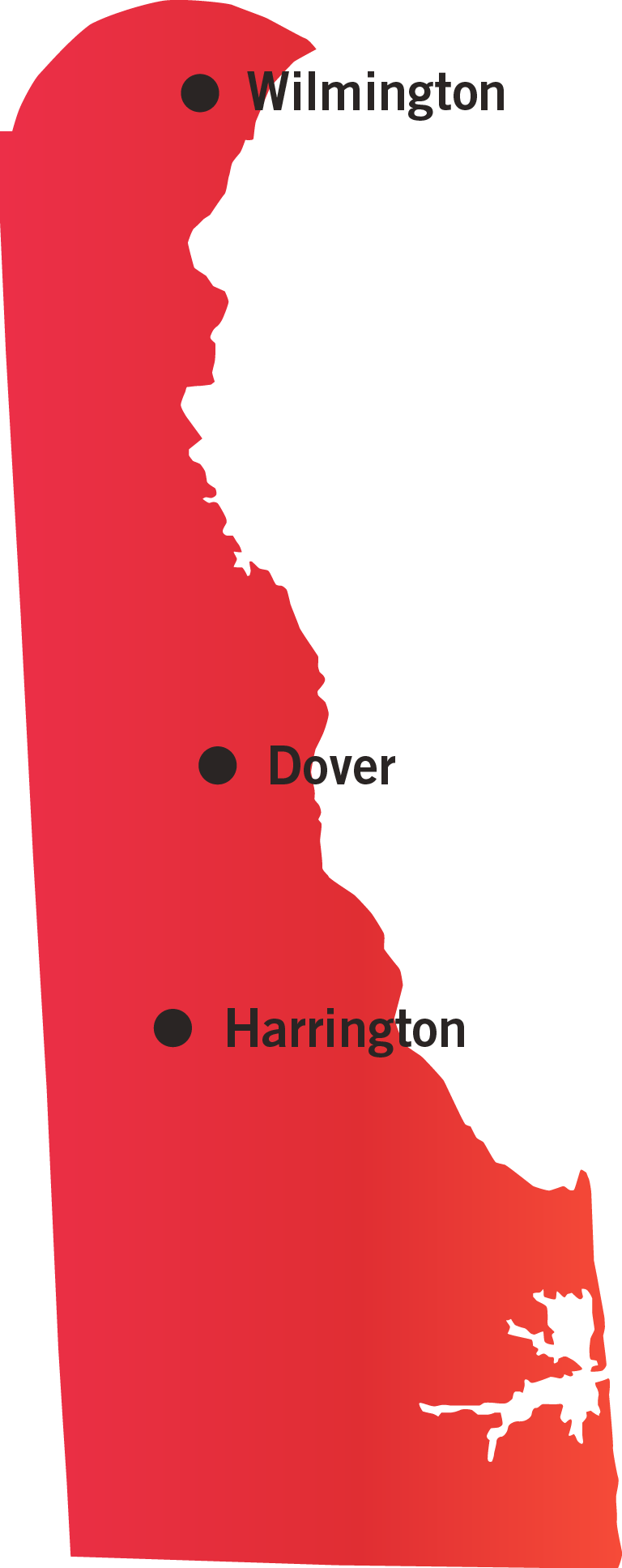

Number of Casinos 3

-

Economic Impact $1.31 Billion

-

Jobs Supported 6,924

-

Tax Impact $344.5 Million

-

Gross Gaming Revenue $502.5 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Delaware Lottery

1575 McKee Road, Suite 102

Dover, DE 19904

302-739-5291

Website

The Delaware State Constitution Art. II §17 generally prohibits gambling but allows for lotteries “under state control for the purpose of raising funds.” The term “lottery” is not defined in the constitution but has been interpreted by state statute to include VLTs, Internet gaming, table games and sports betting.

Consequently, the operation of VLTs, Internet gaming, table games and sports betting in Delaware is supervised by the lottery, a division of the Department of Finance, and governed by the Video Lottery Regulation and Title 29 of the Delaware Code, Chapter 48.

AVAILABLE GAMING LICENSES

Operator License

Gaming Vendor License

Non-gaming Vendor Application

For more information on available gaming licenses, see Regulatory Fact Sheet.

| GAMING TAX RATE |

| 57-58 percent effective rate on gaming machine revenue |

| 20 percent effective rate on table game revenue (Including Internet Table Games) |

TAX PROMOTIONAL CREDITS

Permitted to issue 20 percent of prior year’s net terminal income tax free

WITHHOLDINGS ON WINNINGS

None

TAX ALLOCATION

Revenue from video lottery games is distributed as follows:

• 39 percent to the State General Fund;

• 43 percent to the racetracks as commission;

• 10 percent for horse racing purses; and

• 8 percent in vendor fees.

For table games, 15.5 percent goes to the State General Fund and 4.5 percent goes to horse racing purses.

For the state’s Internet lottery, the operation and administration of Internet gaming is taken off the top. Then, the next $3.75 million goes to the State Lottery Fund. Finally, the revenue distribution is the same for the land-based version of video lottery and table games.

STATUTORY FUNDING REQUIREMENT

$1 million or 1 percent of electronic gaming machine proceeds, whichever is greater. Additionally, $250,000 or 1 percent of table game revenue, whichever is greater.

SELF-EXCLUSION

One year; however, a person may also request a 5-year ban or a lifetime ban.

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

All advertising must be approved by the Delaware State Lottery.

In addition, operators of internet, online, cloud, or mobile websites, services, and applications directed to children are broadly prohibited from advertising gambling offerings.

ON-PREMISE DISPLAY REQUIREMENT

Each slot machine gaming licensee must establish a responsible gaming advertising program

AGE RESTRICTIONS

21+ years of age to gamble

21+ years of age on floor

TESTING REQUIREMENTS

Lottery must contract with independent testing laboratory to test all gaming equipment.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Must obtain written authorization from Director of Delaware State Lottery Office.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

May extend credit in a commercially reasonable manner.

SMOKING BANS

Yes

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Cashless gaming is permitted. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

The Delaware Lottery is charged with regulation and oversight of sports betting, which is limited to the state’s three casinos.

MOBILE/ONLINE

According to lottery officials, mobile sports betting is legal as Delaware allows online gambling, such as poker, but it is not currently offered.

TAX RATE

50 percent

INITIAL LICENSING FEE

None

LICENSE RENEWAL FEE

None

AMATEUR RESTRICTIONS

Ban on betting involving in-state college teams but wagering on college games generally is allowed.

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.