Commercial Gaming Revenue Surpasses $16B in Q2 2023 with 10th Consecutive Quarter of Growth

Industry Generates More Than $7B in Gaming Tax Revenue through H1 2023

Press Release

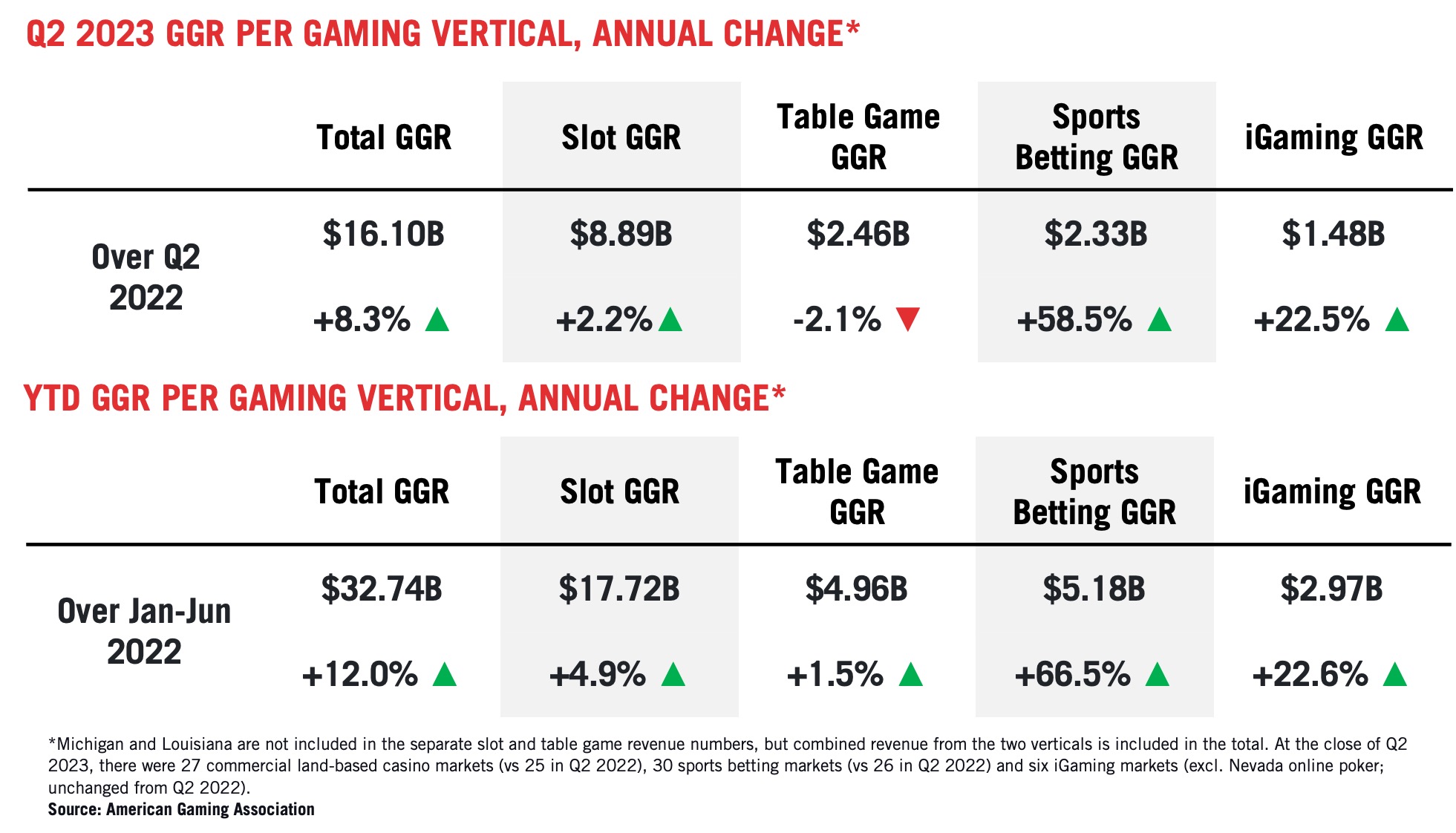

Washington, D.C. – U.S. commercial gaming continued its long run of consecutive quarterly revenue growth in the second quarter, hitting a Q2 record of $16.07 billion, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. The total outpaced Q2 2022 by 8.1 percent and marked the 10th consecutive quarter of annual growth for the commercial gaming industry.

Q2 2023 is the second-highest grossing quarter in industry history, topped only by Q1 2023, making H1 2023 the commercial gaming industry’s strongest half ever. The $32.71 billion in commercial gaming revenue generated in the first six months of 2023 tracks 11.9 percent ahead of the same period last year.

The industry’s strong performance has resulted in an estimated $7.28 billion in direct gaming tax revenue for state and local governments through the first six months of the year. Pacing 12.9 percent ahead of last year, 2023 is on pace to generate more gaming tax revenue than any previous year.

“While commercial gaming is on track for an unprecedented third consecutive year of record revenue, the lasting impact we’re making on our communities through this record growth is even more impressive,” said AGA President and CEO Bill Miller.

While land-based gaming continues to account for more than three-quarters of total commercial revenue, the industry’s year-over-year growth is being driven by the online sports betting and iGaming sectors.

Q2 revenue from land-based slots, table games and retail sports betting totaled $12.38 billion, a slight increase (+0.9%) compared to the previous year. Meanwhile, revenue from online gaming rose 43.1 percent year-over-year in Q2 to $3.68 billion, in part driven by the introduction of mobile sports betting in Kansas, Maryland, Massachusetts and Ohio within the past year.

Combined online and land-based sports betting revenue totaled $2.3 billion in Q2 2023, an industry record for any second quarter and a 56.6 percent year-over-year increase. Meanwhile, online casino gaming tied Q1 for its highest-grossing quarter ever, generating $1.48 billion in revenue, up 22.5 percent over Q2 2022.

Across the country, 23 of 34 commercial gaming jurisdictions that were operational one year ago saw increased Q2 revenue from 2022.

“These results are a clear indication that our post-pandemic recovery wasn’t a fluke: the gaming sector continues to thrive, and when we do well, our communities do well,” continued Miller. “To sustain this momentum, the AGA will continue enlisting more allies in our fight against the illegal market, bolstering responsible gaming, and building a business environment that allows our innovative industry to bring world-class entertainment to adults across America.”

Background

- AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights Q2 2023 results.

- 34 states and the District of Columbia featured operational commercial gaming markets in Q2 2023, including casino gaming, sports betting and iGaming.

- AGA’s State of Play Map charts gaming’s economic impact, industry regulations and casino locations on a state-by-state basis for both the commercial and tribal gaming sectors.

About the AGA

As the national trade group representing the U.S. casino industry, the American Gaming Association (AGA) fosters a policy and business environment where legal, regulated gaming thrives. The AGA’s diverse membership of commercial and tribal casino operators, sports betting and iGaming companies, gaming suppliers, and more lead the $261 billion industry and support 1.8 million jobs across the country.