State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

All location data is as of Dec. 31, 2022.

-

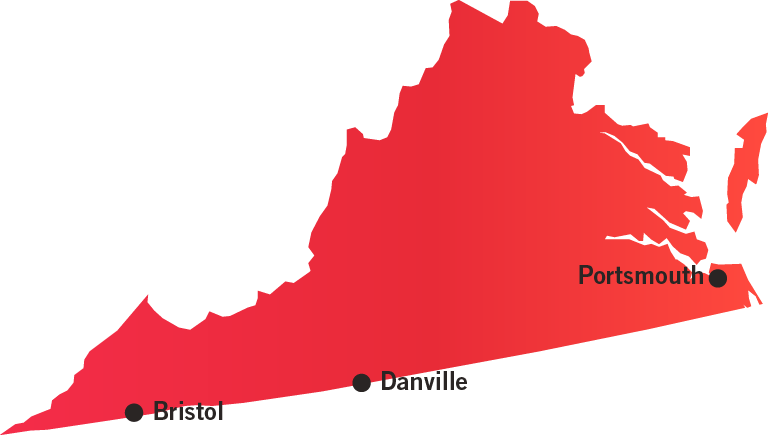

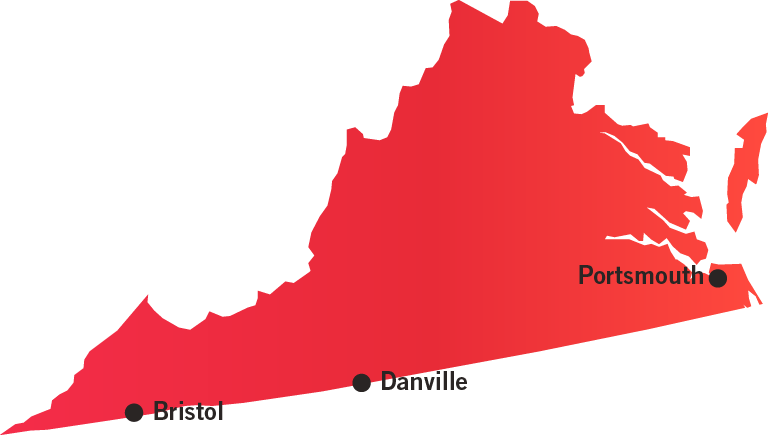

Number of Casinos 3

-

Economic Impact $2,16 Billion

-

Jobs Supported 8,098

-

Tax Impact $272.0 Million

-

Gross Gaming Revenue $1.12 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Virginia Lottery Board

600 East Main Street

Richmond VA 23219

804-692-7000

Website

The Virginia Lottery Board is the regulatory authority for casino gaming in the state.

AVAILABLE GAMING LICENSES

Operator License

Supplier’s Permit

For more information on available gaming licenses, see Regulatory Fact Sheet.

GAMING TAX RATE

There is a graduated tax on casino revenue, requiring operators to pay 18 percent on their first $200m, 23 percent on revenues between $200m and $400m, and 30 percent on any revenues of more than $400m.

TAX PROMOTIONAL CREDITS

In Virginia, promotional credits may not be deducted from the operator’s gross gaming revenue.

WITHHOLDINGS ON WINNINGS

The Lottery Department must withhold Virginia income tax at the rate of 4 percent on the proceeds from any lottery prize in excess of $5,000.

TAX ALLOCATION

Tax revenues are deposited in the newly created Gaming Proceeds Fund. Revenues from the fund are largely appropriated by the General Assembly for programs established to address public school construction, renovations, or upgrades. Additionally, a portion of the proceeds is returned to the casino host city, the Virginia Indigenous People’s Trust Fund, the Problem Gambling Treatment and Support Fund, and the Family and Children’s Trust Fund.

STATUTORY FUNDING REQUIREMENT

Eight-tenths of one percent of the Gaming Proceeds Fund must be appropriated to the Problem Gambling Treatment and Support Fund.

SELF-EXCLUSION

The Virginia Lottery Board has adopted regulations to establish and implement a voluntary exclusion program. A person who participates in the voluntary exclusion program may choose an exclusion period of two years, five years or lifetime.

COMPLIMENTARY ALCOHOLIC DRINKS

No

ADVERTISING RESTRICTIONS

Yes

ON-PREMISE DISPLAY REQUIREMENT

Yes

AGE RESTRICTIONS

21+ years of age to gamble

21+ of age on floor

TESTING REQUIREMENTS

All gaming equipment must be tested and certified by an independent testing laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

The Virginia Lottery Department must be notified of all shipments of gaming equipment.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None.

CREDIT OFFERED TO PATRONS

Prohibited.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Patrons are also permitted to deposit cryptocurrency.

AUTHORIZED OPERATORS

Commercial casino & online operators. State legislation authorizes up to 12 online operators in the state.

MOBILE/ONLINE

Allowed statewide

TAX RATE

Sports wagering is taxed at 15 percent of adjusted gross gaming revenue (AGR). However, in calculating AGR, permit holders may deduct various payments.

INITIAL LICENSING FEE

$50,000 for each of the “principals” named as part of their application. If issued a permit, operators will then be required to pay an additional fee of $250,000

LICENSE RENEWAL FEE

$200,000 every three years.

AMATEUR RESTRICTIONS

Wagering on the following types of events are prohibited:

- Bets on youth sports.

- Proposition bets on college sports.

- Bets on Virginia college sports. However, the prohibition does not prohibit betting on games in a tournament or multigame event in which a youth sports or Virginia college sports team participates, so long as the games do not have a participant that is a youth sports or Virginia college sports team.

TAX OF PROMOTIONAL CREDITS

Value of bonuses or promotions provided to patrons can be deducted from the calculation of Adjusted Gross Revenue.

AGE RESTRICTIONS

Must be 21 years old.