State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

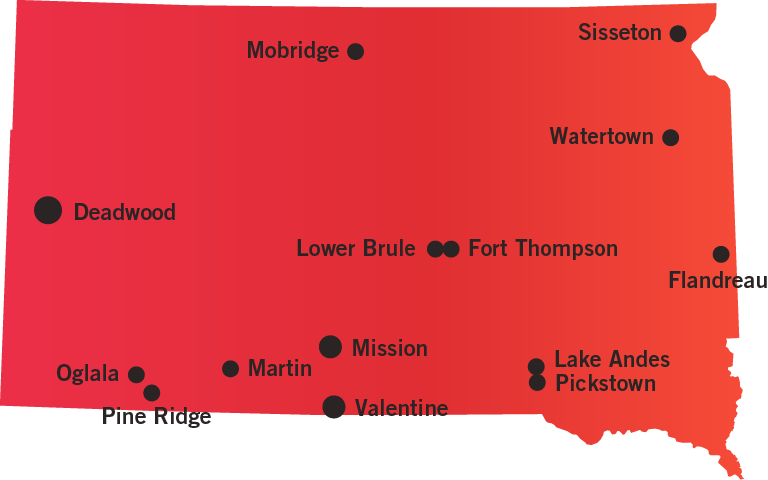

Number of Casinos 35

-

Economic Impact $622.6 Million

-

Jobs Supported 4,969

-

Tax Impact & Tribal Revenue Share $86.7 Million

-

Gross Gaming Revenue $147.6 Million (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

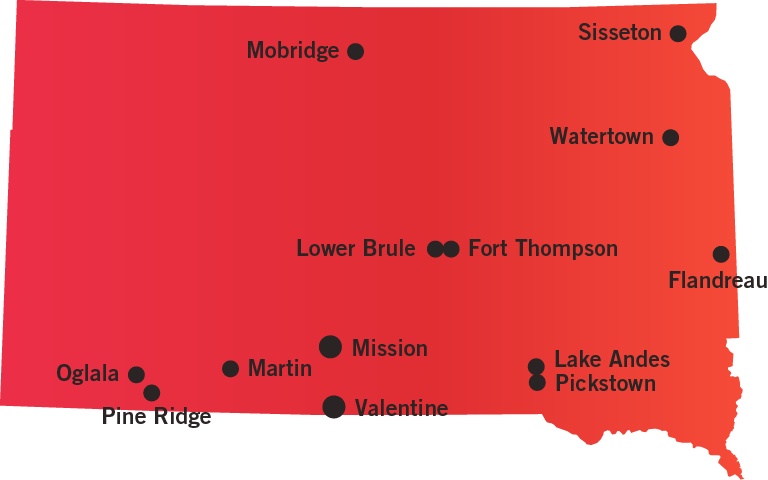

Number of Casinos 22

-

Economic Impact $427.3 Million

-

Jobs Supported 2,191

-

Tax Impact $49.6 Million

-

Gross Gaming Revenue $147.6 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 13

-

Economic Impact $195.3 Million

-

Jobs Supported 2,778

-

Tax Impact & Tribal Revenue Share $37.1 Million

-

Gross Gaming Revenue $148.0 Million (2016)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

The South Dakota Commission on Gaming

120 Industrial Dr., Suite 1,

Spearfish, SD 57783

605-578-3074

Website

The South Dakota Commission on Gaming was established under Chapter 42-07B of the South Dakota Codified Laws (SDCL) to regulate the limited slot machines and card games allowed by the state within the city of Deadwood. The licensing and regulation of the casinos which offer these games falls to the commission.

AVAILABLE GAMING LICENSES

Casino Operator License

Retail Operator License

Slot Machine Manufacturer/Distributor License

Slot Route Operator License

Nine tribes in South Dakota operate Class III gaming in the state pursuant to tribal-state gaming compacts.

Under the compacts, tribes must appoint a tribal gaming commission to supervise gaming activities, issue licenses, inspect premises where gaming is conducted and otherwise be responsible for enforcing compact provisions.

The state also serves a part in overseeing tribal gaming operations in the state, with soome of the state’s primary responsibilities being aiding in the licensing process and inspecting gaming machines.

In general, most tribes in South Dakota and authorized to operate between 250 and 500 gaming machines. However, through the extension of some compacts, some tribes may operate more gaming machines.

Tribal gaming compacts are up for review for every few years, with some earlier compacts being reviewed every two years, and the state’s most recent compact being reviewed every 10 years.

AVAILABLE GAMING LICENSES

The tribes must investigate and license employees at gaming establishments in the state.

GAMING TAX RATE

9 percent effective rate.

TAX PROMOTIONAL CREDITS

Free play value provided by an operator may not be included in the gross proceeds. Cash prizes deducted must be adjusted to not include an amount equal to 90 percent of the free play value provided by the operator.

WITHHOLDINGS ON WINNINGS

None

| TAX ALLOCATION |

| The gaming tax is distributed by allocating 40 percent to the Tourism Promotion Fund, 10 percent to Lawrence County and the remaining 50 percent in the following manner: |

| The first $100,000 to the State Historical Preservation Grant and Loan Fund and up to $30,000 can be distributed to the Department of Social Services for Gambling Addiction Treatment and Counseling Program grants. |

| The next $6.8 million is to go to City of Deadwood. |

| If any remaining funds, to be disbursed as follows: |

|

REVENUE SHARE

A majority of the tribes do not share any revenue with the state. However, in September 2016, the Flandreau Santee Sioux Tribe signed a new compact which will allow the tribe to offer more slot machines at their casino in exchange for payments to the state.

TAX PROMOTIONAL CREDITS

No

WITHHOLDINGS ON WINNINGS

A percentage of gaming winnings are not withheld for state tax purposes. However, federal law may require tribal casinos to issue a W-2G form to persons and may withhold winnings if certain conditions are met. For more information click here.

STATE USE OF REVENUE

Not available

TRIBAL USE OF REVENUE

As per the tribal-state compacts, some tribes, in their discretion, may contribute money to be used to provide public services to counties/cities near their gaming operations.

STATUTORY FUNDING REQUIREMENT

Not to exceed $30,000 from the Gaming Commission fund to the Department of Social Services

SELF-EXCLUSION

A licensee conducting gaming must develop a self-exclusion plan or voluntary exclusion plan to prevent any person, who informs the licensee of that person’s desire to participate in a self-exclusion or voluntary exclusion program, from participating in gaming.

COMPLIMENTARY ALCOHOLIC DRINKS

South Dakota’s gaming statutes and regulations prohibit casinos from offering complimentary alcoholic beverages to patrons.

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

Yes

AGE RESTRICTIONS

Gambling participants in South Dakota must be 21 years of age or older.

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

Some casinos in the state are dry. Other casinos allow players to use rewards points to receive free and reduced alcoholic beverages.

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

A person must be 21 years of old to participate in Class III gaming.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

Commission on Gaming must approve all slot machines distributed in the state.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Must obtain written authorization from the executive director of the SDCG.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. South Dakota gaming statutes and regulations do not prohibit specific payment types. Additionally, South Dakota does not accept cryptocurrency as a form of payment.

TESTING REQUIREMENTS

Gaming devices must be tested and approved by a gaming test laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act apply.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

No

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. South Dakota tribal regulations do not prohibit specific payment types. Additionally, South Dakota does not accept cryptocurrency as a form of payment.

AUTHORIZED OPERATORS

Casinos located within the city of Deadwood

MOBILE/ONLINE

Allowed on the premises of casinos located within the city of Deadwood

TAX RATE

9 percent

INITIAL LICENSING FEE

$200 paid on an annual basis

LICENSE RENEWAL FEE

$200 paid on an annual basis

AMATEUR RESTRICTIONS

Wagering on the following types of events are prohibited:

- Bets on high-school sports.

- Proposition bets on college sports.

- Bets on South Dakota college sports.

TAX ON PROMOTIONAL CREDITS

Free play value provided by an operator may not be included in the gross proceeds. Cash prizes deducted must be adjusted to not include an amount equal to 90 percent of the free play value provided by the operator.

AGE RESTRICTIONS

Must be 21 years old.