State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

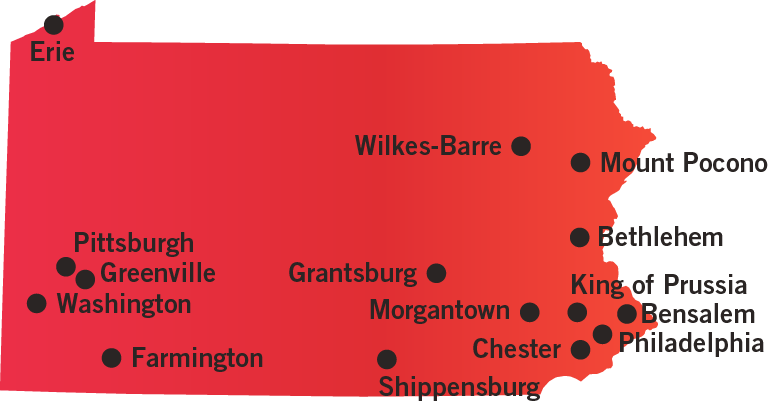

Number of Casinos 17

-

Economic Impact $14.68 Billion

-

Jobs Supported 64,933

-

Tax Impact $3.62 Billion

-

Gross Gaming Revenue $5.86 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Pennsylvania Gaming Control Board

303 Walnut Street, 2nd Floor

Strawberry Square

Harrisburg, PA 17106

(717) 346-8300

Website

Section 1201 of title 4 of the Pennsylvania Consolidated Statutes establishes the Pennsylvania Gaming and Control Board (PGCB). The board is tasked with supervising casinos as well as slot machines at racetracks, online casino gaming and sports betting.

AVAILABLE GAMING LICENSES

Category One – Racetrack Facilities License

Category One – Racetrack Facilities, Addition of Table Games License

Category Two – Standalone Casino License

Category Two – Standalone Casino, Addition of Table Games License

Category Three – Resort-style Casino License

Category Three – Resort-style Casino, Addition of Table Games License

Category Four – Ancillary Casino License

Category Four – Ancillary Casino, Addition of Tables Games License

Interactive Gaming Certificate

Interactive Gaming Operator License

Manufacturers License

GAMING TAX RATE

Casinos pay the following:

- 54-55 percent on the gross revenues collected from slot machines

- 16 percent of daily gross table game revenues

- 34 percent of daily gross electronic table game revenues

Effective tax rates for online gaming are:

- 16 percent on peer-to-peer games (i.e., poker).

- 16 percent on non-peer-to-peer table games.

- 54 percent on slot machine games.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

Gambling winnings are taxable income and are taxed at 3.07 percent.

| TAX ALLOCATION |

| The effective tax rate on slot machine revenues from Category 1, 2, and 3 casinos is 54 percent and is distributed as follows: |

|

| The effective tax rate for Category 4 casinos is 50 percent and is distributed as follows: |

|

STATUTORY FUNDING REQUIREMENT

The greater of $2 million or .002 multiplied by the total gross terminal revenue of all active and operating licensed gaming entities. Category Four gross terminal revenue is excluded. Additionally, $3 million must be transferred to the Department of Health.

SELF-EXCLUSION

Yes

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

Must contain help for problem gambling message

ON-PREMISE DISPLAY REQUIREMENT

Preapproved by Office of Compulsive and Problem Gambling

AGE RESTRICTIONS

21+ years of age on floor

TESTING REQUIREMENTS

Conducted through the Bureau of Gaming Laboratory Operations, division within the PGCB.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements and PA-specific “suspicious transactions” report requirements for transactions over $5,000.

SHIPPING REQUIREMENTS

Notification of intention to ship into, within or out of state to Bureau of Gaming Laboratory Operations and Bureau of Casino Compliance.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

In September 2018, Pennsylvania’s blanket prohibition on political contributions from those involved in the gaming industry was struck down in federal court. The opinion declared the law overly broad and unconstitutional.

CREDIT OFFERED TO PATRONS

Yes

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Additionally, Pennsylvania does not accept cryptocurrency as a form of payment.

AUTHORIZED OPERATORS

Commercial casinos, racinos & online operators

MOBILE/ONLINE

Allowed statewide

TAX RATE

36 percent

INITIAL LICENSING FEE

$10 million

LICENSE RENEWAL FEE

$250,000, payable every 5 years

AMATEUR RESTRICTIONS

None

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.