State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

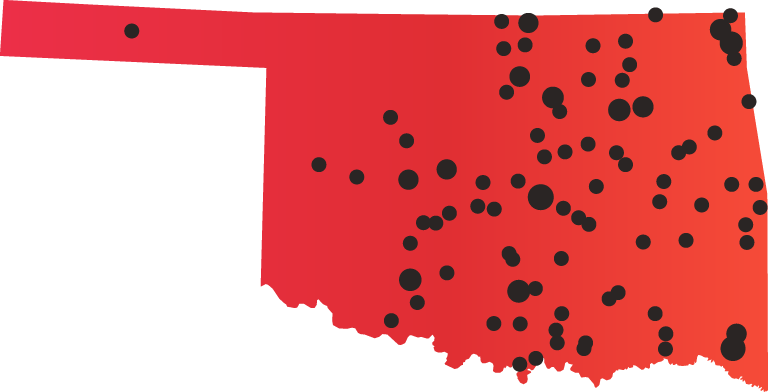

Number of Casinos 141

-

Economic Impact $12.19 Billion

-

Jobs Supported 89,402

-

Tax Impact & Tribal Revenue Share $2.00 Billion

-

Gross Gaming Revenue $151.4 Million (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

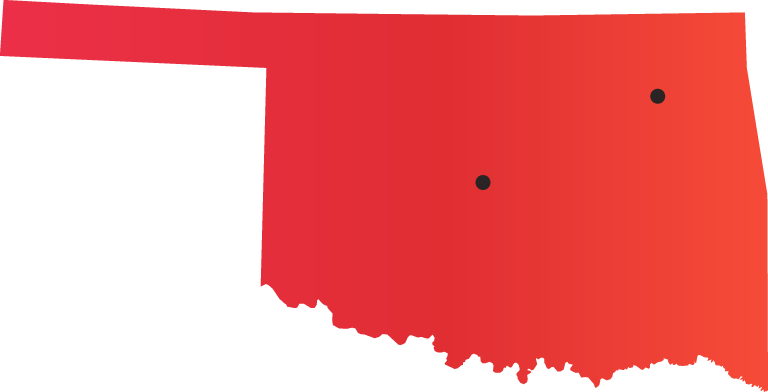

Number of Casinos 2

-

Economic Impact $900.3 Million

-

Jobs Supported 4,515

-

Tax Impact $144.1 Million

-

Gross Gaming Revenue $151.4 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

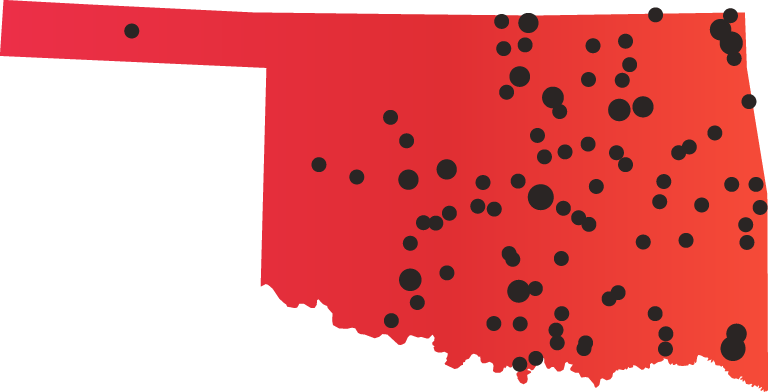

Number of Casinos 139

-

Economic Impact $11.29 Billion

-

Jobs Supported 84,887

-

Tax Impact & Tribal Revenue Share $1.85 Billion

-

Gross Gaming Revenue $4.36 Billion (2016)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Oklahoma Horse Racing Commission

2800 N Lincoln Bld, Suite 220

Oklahoma City, OK 73105

In Oklahoma, electronic amusement games, electronic bonanza-style bingo games and electronic instant bingo games can be played at racetracks. The Oklahoma Horse Racing Commission monitors them. Any Oklahoma racetrack seeking to operate casino-style games is required to apply for a license from the Oklahoma Horse Racing Commission.

The commission consists of nine members appointed by the governor with the advice and consent of the Senate. Okla. Stat. tit. 3A § 201. Section 202 and 203.1 of Title 3A of the Oklahoma Statutes outline conflicts of interests for commissioners and prohibited activities while acting as a commissioner. The commission also appoints an executive director, in charge of enforcement.

AVAILABLE GAMING LICENSES

Racetrack Gaming Operator License

Manufacturer License

Distributor License

Manufacture/Distributor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

There are 35 compacted tribes in Oklahoma.

Tribes are responsible for oversight of tribal casinos. However, the compacts give Oklahoma’s Office of State Finance some limited regulatory scope over tribal gaming to ensure compliance with compact provisions. This entity is also referred to as the State Compliance Agency (SCA) in the compacts.

The state has the authority to monitor the conduct of covered games to ensure that the covered games are conducted in compliance with the compact.

Oklahoma also has a model tribal gaming compact. The information outlined below is from the state model tribal gaming compact, actual compacts may vary slightly tribe to tribe.

AVAILABLE GAMING LICENSES

Provider of Class III Gaming Equipment of Supplies License

For more information on available gaming licenses, see Regulatory Fact Sheet.

| GAMING TAX RATE | ||

| Gross gaming revenues from electronic games at commercial casinos in Oklahoma is taxed at a graduated rate: | ||

| Gross Gaming Revenue | Share to State | Share to Horse Racing |

| $0 – $10m | 10% | 25% or 30% |

| $10m – 30m | 10% | 30% |

| $30m – 40m | 15% | 30% |

| $40m – $50m | 20% | 25% |

| $50m – $70m | 25% | 22.5% |

| Over $70m | 30% | 20% |

TAX PROMOTIONAL CREDITS

Yes

WITHHOLDINGS ON WINNINGS

Casino winnings are taxed as supplementary wages under state tax law.

TAX ALLOCATION

Of the fund distributed to the state, 12 percent goes to the General Revenue Fund and 88 percent goes to the Education Reform Revolving Fund.

| REVENUE SHARE | |

| In Oklahoma, tribes share revenues with the state in the following manner: | |

| Adjusted Net Revenues | Share to State |

| $0 – $10m | 4% |

| $10m – $20m | 5% |

| Over $20m | 6% |

| Additionally, tribes share 10 percent of monthly net win from nonhouse-banked card games. | |

TAX PROMOTIONAL CREDITS

Taxed as normal revenue

WITHHOLDINGS ON WINNINGS

The state does not withhold percentages of gambling winnings for state purposes. However, federal law may require tribal casinos to issue a W-2G form to persons and may withhold winnings if certain conditions are met. For more information click here.

STATE USE OF REVENUE

Under Section 3A-280 of the Oklahoma Code, 12 percent of revenue to the state from tribal gaming must go to the General Revenue Fund and 88 percent of revenue to the state from tribal gaming must go to the Education Reform Revolving Fund.

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

Oklahoma must alert players of resources available to compulsive gamblers and their families.

AGE RESTRICTIONS

There are no restrictions on minors being on the premises of racetracks.

STATUTORY FUNDING REQUIREMENT

First $20,833.33 shared by each tribe for gambling addiction programs.

SELF-EXCLUSION

Compacts require tribes to set up self-exclusion programs.

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

No

ON-PREMISE DISPLAY REQUIREMENT

Signs and other materials should be available to alert patrons where they can receive problem gambling services.

AGE RESTRICTIONS

Persons must be 18 years of age to participate in Class III gaming.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

Notice to OHRC, to be certified by independent testing laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Must notify OHRC prior to shipment into/out of state.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

Must submit procedures that prohibit the offering of credit in the compulsive gambling assistance program.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

TESTING REQUIREMENTS

Electronic gaming machines must be certified by an independent testing laboratory and the TCA.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act apply.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

LEGAL SINGLE GAME SPORTS BETTING

Not allowed