State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

Number of Casinos 26

-

Economic Impact $11.74 Billion

-

Jobs Supported 60,669

-

Tax Impact & Tribal Revenue Share $2.01 Billion

-

Gross Gaming Revenue $3.58 Billion (2023 Commercial)

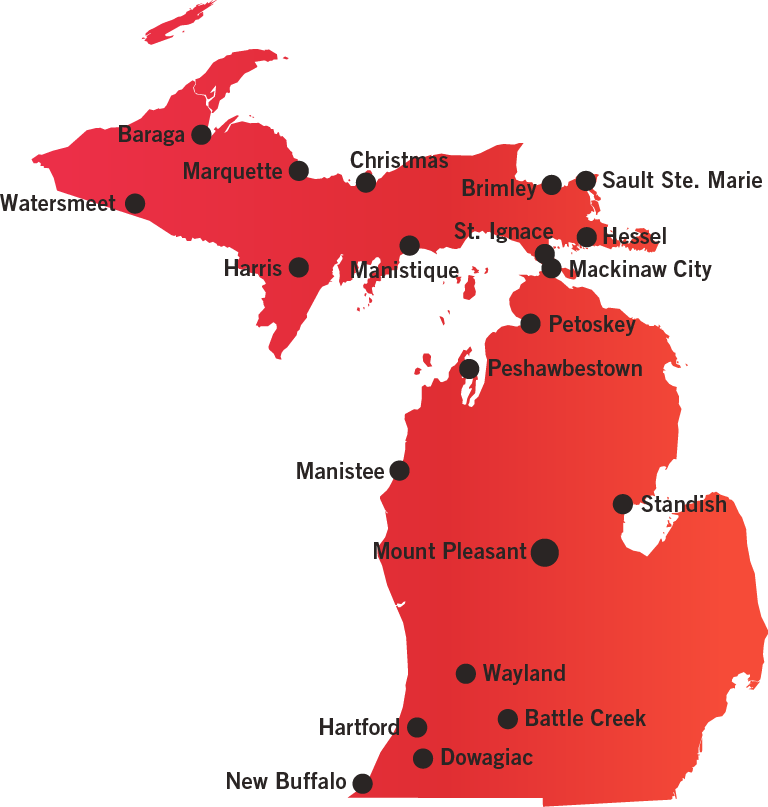

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 3

-

Economic Impact $8.69 Billion

-

Jobs Supported 34,964

-

Tax Impact $1.48 Billion

-

Gross Gaming Revenue $3.58 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 23

-

Economic Impact $3.05 Billion

-

Jobs Supported 25,705

-

Tax Impact & Tribal Revenue Share $526.9 Million

-

Gross Gaming Revenue $1.42 Billion (2016)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Michigan Gaming Control Board

3062 West Grand Boulevard, Suite L-700

Detroit, MI 48202-6062

313-456-4100

Website

The Michigan Gaming Control Board regulates casino gaming and sports betting in Michigan, including online. The MGCB is part of the state’s department of treasury. The MGCB consists of five members, who are appointed by the governor with the advice and consent of the Senate. Terms on the board last for four years. The MGCB is run by an executive director who is appointed for a six-year term. The MGCB promulgates the administrative rules necessary to operate the state’s three commercial casinos, sports betting and online casino gaming.

The MGCB is run by an executive director who is appointed for a six-year term. The MGCB promulgates the administrative rules necessary to operate the state’s three commercial casinos.

AVAILABLE GAMING LICENSES

Casino Operator License

Supplier License

Internet Gaming Operator

Internet Gaming Platform Provider

For more information on available gaming licenses, see Regulatory Fact Sheet.

Michigan has tribal-state gaming compacts with 12 tribes. There are seven tribes operating under compacts agreed to in 1993, four tribes under compacts agreed to in 1998 and one tribe operating under a compact agreed to in 2007.

The tribes operating under 1993 compacts are:

- The Bay Mills Indian Community

- The Grand Traverse Band of Ottawa and Chippewa Indians

- The Hannahville Indian Community

- The Lac Vieux Desert Band of Lake Superior Chippewa Indians

- The Saginaw Chippewa Indian Tribe

- The Sault Ste. Marie Tribe of Chippewa

- The Keweenaw Bay Indian Community

The tribes operating under 1998 compacts are:

- The Little Traverse Bay Band of Odawa Indians (2003 and 2008 amendments)

- The Nottawaseppi Huron Band of Potawatomi Indians (2009 amendment)

- The Pokagon Band of Potawatomi Indians (2008 amendment)

- The Little River Band of Ottawa Indians (2008 amendment)

The tribe operating under the 2007 compact is the Gun Lake Band of Match-E-Be-Nash-She-Wish Band of Potawatomi Indians.

A representative from the state, as authorized by the governor, has the right to inspect Class III gaming facilities and tribal records related to Class III gaming.

The 1993 compacts had an initial term of 20 years and were extended an additional five years. The state and tribes have commenced negotiations for a new compact.

The 1998 compacts also had an initial term of 20 years but were later extended until 2028, except the Nottawaseppi Huron Band of Potawatomi Indians extended their compact until 2030.

The 2007 compact has a 20-year term and can be renewed for an additional five year period.

AVAILABLE GAMING LICENSES

Providers of Class III Gaming Equipment or Supplies License

For more information on available gaming licenses, see Regulatory Fact Sheet.

GAMING TAX RATE

There is an 18 percent tax rate on Gross Gaming Revenue (GGR) with 9.9 percent going to the city of Detroit and 8.1 percent going to the state. Additionally, Detroit commercial casinos are subject to an additional municipal service fee of 1.25 percent of adjusted gross receipts or $4m, whichever is greater.

TAX PROMOTIONAL CREDITS

Yes

WITHHOLDINGS ON WINNINGS

4.25 percent withheld

TAX ALLOCATION

The city wagering tax is used for, among other things, the bolstering of the police force, neighborhood and development programs, public safety programs, anti-gang programs, capital improvements, and road improvements.

The entire State Wagering Tax is deposited into the School Aid Fund for statewide K-12 classroom education.

| REVENUE SHARE All tribes in the state pay two percent of their annual net win to local units of government in Michigan. |

|

| 1993 COMPACT | |

| The Keweenaw Bay Indian Community and the Hannahville Indian Community are the only tribes under the 1993 compact that share revenue with the state. Keweenaw Bay provides 8 percent in revenue sharing to Michigan Economic Development Corporation (MEDC) and Strategic Fund (MSF) while Hannahville remints 2-7 percent to the MEDC and MSF. | |

| 1998 COMPACT | |

| Gross Gaming Revenue | Share to State |

| Up to $75m | 4% |

| $75m – $150m | 6% |

| Over $150m | 8% |

| 2007 COMPACT | |

| Gross Gaming Revenue | Share to State |

| Up to $150m | 8% |

| $150m – $300m | 10% |

| Over $300m | 12% |

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

None

STATE USE OF REVENUE

2 percent to Local Revenue Sharing Board, the rest given to Michigan Economic Development Corporation.

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

$2 million is deposited into a Compulsive Gaming Prevention Fund

SELF-EXCLUSION

Participation is voluntary, but once on the list, a self-excluded person’s name will be on it for life.

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

A casino licensee shall not market its services or send advertisements to those persons whose names are on the list of disassociated persons.

ON-PREMISE DISPLAY REQUIREMENT

The compulsive gaming helpline number must be posted at each entrance and exit of the casino, on each electronic funds transfer terminal, and at each credit location.

AGE RESTRICTIONS

21+ years of age to gamble.

Employees 18+ are permitted on floor. An employee under the age of 21 shall not perform any function involved in gambling by the patrons.

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

Not expressly required in Compacts but some tribes do offer self-exclusion

COMPLIMENTARY ALCOHOLIC DRINKS

While the compacts are generally silent on the treatment of alcohol in the state, some tribes offer alcohol on complimentary or at a reduced cost while other tribes in the state do not.

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

Persons must be 18 – 21 years of age, depends on particular compact.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

MGCB must approve all machines, can use independent gaming test laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Five-day notification to the MGCB before delivery.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None.

CREDIT OFFERED TO PATRONS

Credit may only be offered in a commercially reasonable manner.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently permitted as a form of payment for gambling transactions.

TESTING REQUIREMENTS

Games must meet the technical equipment standards of the State of Michigan or applicable standards established by the National Indian Gaming Commission, whichever is more restrictive.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act apply.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

Tribes may offer credit to patrons at casinos.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently permitted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

Commercial and tribal casinos.

MOBILE/ONLINE

Allowed statewide

TAX RATE

Land-based: 8.4%

Commercial online: 9.65%

Trial online: 8.4%

INITIAL LICENSING FEE

$100,000

LICENSE RENEWAL FEE

$50,000 annually

AMATEUR RESTRICTIONS

Prohibited to offer wagers on sport or athletic events played by individuals that are at the high school level or below.

TAX ON PROMOTIONAL CREDITS

Yes

AGE RESTRICTIONS

Must be 21 years old.