State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

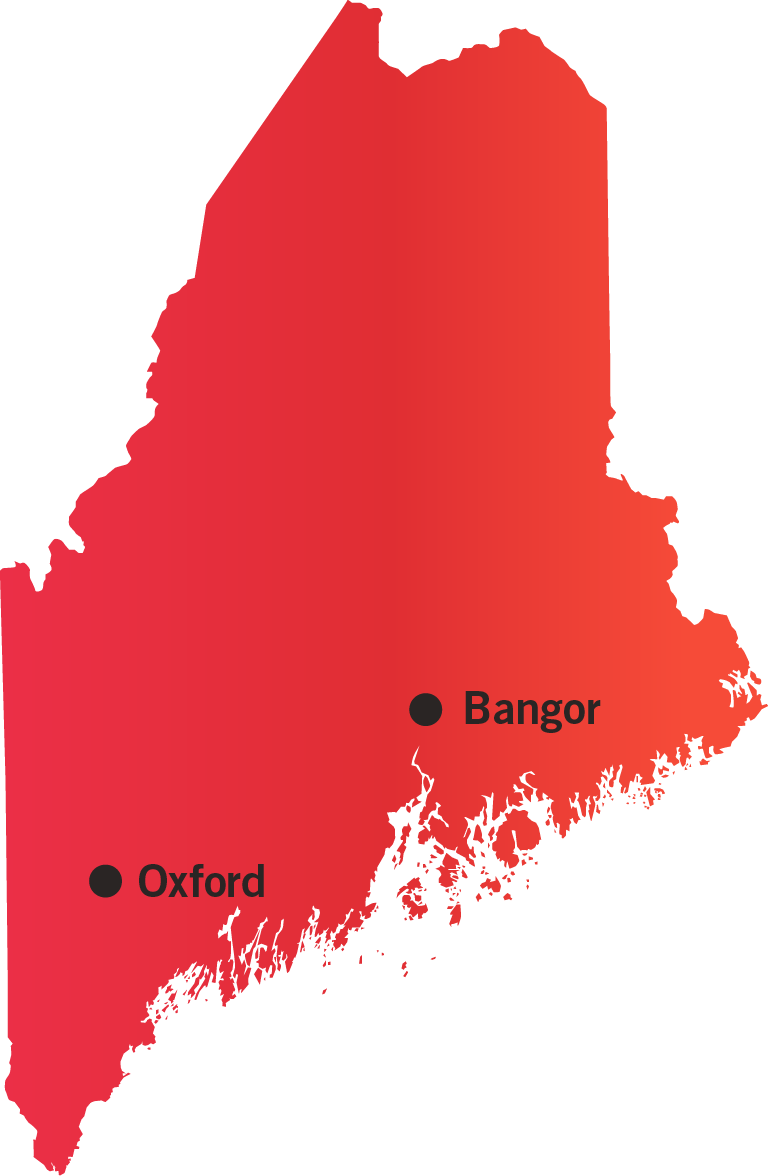

Number of Casinos 2

-

Economic Impact $582.4 Million

-

Jobs Supported 3,232

-

Tax Impact $86.6 Million

-

Gross Gaming Revenue $175.1 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Maine Gambling Control Board

45 Commerce Drive

Suite 3

Augusta, Maine 04333-0087

207-626-3900

Website

The Maine Gambling Control Board was established in 2004, following the approval of slot machine gambling by Maine voters. There are five members of the Gambling Control Board, all appointed by the governor to serve three-year terms.

Title 8 Chapter 31 of the Maine Revised Statutes contains the laws which regulate the operation and licensing of casino-style gambling in the state.

AVAILABLE GAMING LICENSES

Slot Machine Operator License

Casino Operator License

Slot Machine Distributor License

Table Game Distributor License

Gambling Services Vendor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

| GAMING TAX RATE |

|

|

|

|

TAX PROMOTIONAL CREDITS

Cash prizes, winnings or credits from promotional credits are considered gross slot machine income

WITHHOLDINGS ON WINNINGS

5 percent on gambling winnings in excess of $5,000.

TAX ALLOCATION

The biggest recipient of gaming tax dollars in Maine is higher education through the funding of scholarships to state and community colleges. Gaming tax revenue is also used to support health care, agriculture, the state’s horse racing industry and the local governments that host commercial casinos. An additional beneficiary is a state fund established in 2000 to provide prevention-related services and other healthcare programs for Maine families.

STATUTORY FUNDING REQUIREMENT

Gaming operators are required to transfer $100,000 to the Gambling Addiction and Prevention and Treatment Fund. Casinos are also required to distribute 3% net slot machine income and 9% net table game income for gambling addiction services.

SELF-EXCLUSION

The period of self-exclusion shall be either 1 year, 3 years, 5 years, or a lifetime.

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

All advertising, marketing & promotional materials must be submitted 30 days prior to use. The state prohibits false, misleading & deceptive advertising.

ON-PREMISE DISPLAY REQUIREMENT

Slot machine operators must post notices carrying a gambling addiction warning, as well as information about hotlines and addiction counseling services.

AGE RESTRICTIONS

21+ years to gamble

A person 18 to 20 years of age may be present if that person is a licensed employee.

TESTING REQUIREMENTS

Gaming Control Board must approve all slot machines distributed in the state.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Must obtain written authorization from the executive director of the MGCB.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

No.

CASHLESS GAMING & ALTERNATIVE PAYMENTS

No. Additionally, cryptocurrency is not currently permitted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

The legislation authorizes four federally recognized tribes in Maine (the Aroostook Band of Micmacs, Houlton Band of Maliseet Indians, Passamaquoddy Tribe of Indian Township and the Penobscot Nation) the exclusive right to apply for mobile sports wagering licenses.

Casinos, racetracks and off-track betting sites are permitted to operate land-based sportsbooks

MOBILE/ONLINE

Allowed statewide

TAX RATE

10 percent

INITIAL LICENSING FEE

Operators: $4,000

Mobile operators: $200,000

LICENSE RENEWAL FEE

Operators: $4,000, payable every four years

Mobile operators: $200,000, payable every four years

AMATEUR RESTRICTIONS

Operators may allow wagering on any professional sports or athletic event, collegiate sports or athletic event or amateur sports or athletic event.

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.