State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

Number of Casinos 24

-

Economic Impact $7.62 Billion

-

Jobs Supported 44,110

-

Tax Impact & Tribal Revenue Share $1.26 Billion

-

Gross Gaming Revenue $2.70 Billion (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 19

-

Economic Impact $6.36 Billion

-

Jobs Supported 32,415

-

Tax Impact $1.11 Billion

-

Gross Gaming Revenue $2.70 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

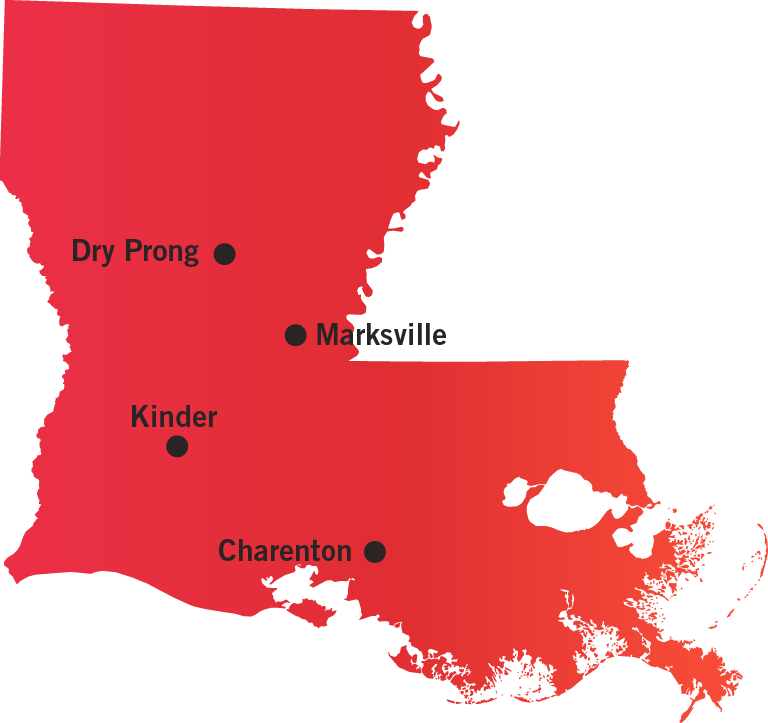

Number of Casinos 5

-

Economic Impact $1.27 Billion

-

Jobs Supported 11,695

-

Tax Impact & Tribal Revenue Share $154.4 Million

-

Gross Gaming Revenue $577.9 Million (2016)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Louisiana Gaming Control Board

7901 Independence Boulevard

Building A

Baton Rouge, Louisiana 70806

225-925-1846

The responsibility for supervising the casino industry is divided between the Louisiana Gaming Control Board, the Louisiana State Police Gaming Enforcement Division and the Office of the Attorney General’s Gaming Division.

The Louisiana Gaming Control Board consists of nine members appointed by the governor. The board’s powers consist of licensing, enforcement and investigation of licensees operating under the Louisiana Riverboat Economic Development and Gaming Control Act, the Louisiana Economic Development and Gaming Corporation Act, and the Video Draw Poker Devices Control Law. The board also oversees casino gaming on Indian lands as provided in the provisions of Act No. 888 (1990) and Act No. 817 (1993).

The gaming enforcement division works as the investigative arm of the Gaming Control Board. The division visits gaming entities and ensures compliance with gaming statutes. It also enforces general criminal laws to prevent dishonest practices or corruption in the casino sector, in addition to its main task of detecting administrative violations.

AVAILABLE GAMING LICENSES

Land-based Casino License

Riverboat Casino License

Racetrack Casino License

Manufacturer Permit

Gaming Supplier Permit

Non-Gaming Supplier Permit

For more information on available gaming licenses, see Regulatory Fact Sheet.

Louisiana has three compacted tribes: the Tunica Biloxi Tribe of Louisiana, the Coushatta Tribe of Louisiana, and the Chitimacha Tribe of Louisiana. The tribal-state compacts are substantially similar for all three tribes, with only minor differences in licensing fees.

The tribal gaming commission has the primary responsibility for the on-site regulation, control and security of the gaming operation.

The State of Louisiana has the limited authority to monitor and inspect the gaming operations to ensure that the gaming operation is conducted in compliance with the compact and applicable regulations.

Tribal compacts are effective for seven years, to be automatically extended seven more years unless the tribe or state provides written notice of non-renewal not less than 180 days prior to the expiration of the original term of the compact.

AVAILABLE GAMING LICENSES

Management Company License

Gaming Manufacturer and Supplier License

Non-Gaming Manufacturer and Supplier License

For more information on available gaming licenses, see Regulatory Fact Sheet.

RIVERBOAT CASINOS

21.5% on gaming revenue, with additional taxes and fees applied by local governments.

RACETRACK CASINOS

Effective tax rate of around 36% of gaming revenue.

LAND-BASED CASINOS

For the state’s land-based casino, it pays the greater of 18.5% of gross revenues or an annual fee of $60m.

TAX PROMOTIONAL CREDITS

Taxed as normal revenue

WITHHOLDINGS ON WINNINGS

6% on slot machine winnings over $1,200

TAX ALLOCATION

The state’s portion of gaming tax is allocated annually at the discretion of the state legislature. The tax is contributed to the State General Fund, public retirement systems, state capital improvements and the state’s rainy-day fund.

REVENUE SHARE

The Coushatta Tribe of Louisiana must make annual payments to the local governments of Allen Parish and the Town of Elton in the annual amount of $7m. The Tunica-Biloxi Indian Tribe of Louisiana must contribute 6 percent of the net revenues from the conduct of Class III gaming to Avoyelles Parish. Lastly, the Chitimacha Tribe of Louisiana must contribute 6 percent of the net revenues from the conduct of Class III gaming to St. Mary Parish.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

Federal law may require tribal casinos to issue a W-2G form to persons and may withhold winnings if certain conditions are met.

STATE USE OF REVENUE

Local gaming communities use revenue to offset and defray expenses resulting from Class III gaming.

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

1% of slot machine revenue, not to exceed $500,000 from each licensed facility

SELF-EXCLUSION

Yes. Minimum of five years

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

Exterior print advertising including, but not limited to, billboards, must display the toll-free telephone number.

ON-PREMISE DISPLAY REQUIREMENT

Signs displaying the toll-free number must be posted at each public entrance to the designated gaming area and at each public entrance into the casino.

AGE RESTRICTIONS

21+ years to gamble.

Persons under 21 years of age are not allowed to loiter in the gaming area.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Louisiana gaming laws and regulations require all licensees to utilize a cashless wagering system, except for racehorse wagering and the play of slot machines, whereby all players’ money is converted to tokens, electronic cards, or chips used only for wagering in the gaming establishment. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

Not outlined in the compact

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

An individual must be at least 21 years old to gamble at tribal casinos in Louisiana.

OPERATION ON HOLIDAYS

Yes

SMOKING BANS

No.

CASHLESS GAMING & ALTERNATIVE PAYMENTS

No. Louisiana tribal gaming laws and regulations do not outlines cashless and alternative payment methods. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

TESTING REQUIREMENTS

Slot machines in the state must be approved by independent gaming laboratories.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements.

SHIPPING REQUIREMENTS

Must obtain express authorization from various Louisiana agencies before transporting gaming equipment.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

Yes

TESTING REQUIREMENTS

None

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

All Class III gaming must be on a cash or casino credit basis.

AUTHORIZED OPERATORS

The state’s land-based casinos, the state’s 15 riverboat casinos, and the state’s four racetracks

MOBILE/ONLINE

Mobile allowed statewide.

TAX RATE

Land-based: 10 percent

Online/Mobile: 15 percent

INITIAL LICENSING FEE

$500,000

LICENSE RENEWAL FEE

$500,000, payable every year

AMATEUR RESTRICTIONS

Licensees may not accept wagers on high-school sporting events.

TAX ON PROMOTIONAL CREDITS

Eligible promotional play is not taxed by the state. Eligible promotion play cannot exceed $5mil per year.

AGE RESTRICTIONS

Must be 21 years old.