State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

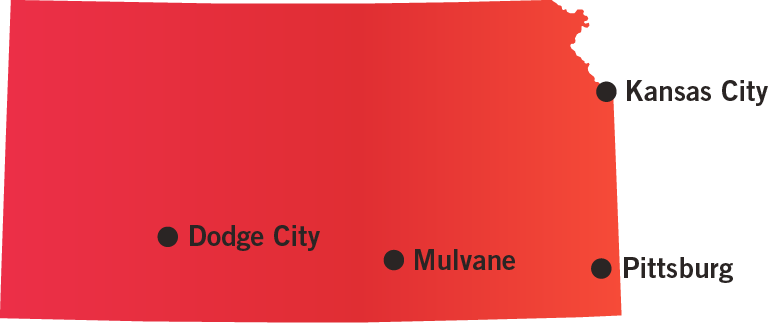

Number of Casinos 11

-

Economic Impact $2.42 Billion

-

Jobs Supported 13,924

-

Tax Impact & Tribal Revenue Share $331.7 Million

-

Gross Gaming Revenue $588.3 Million (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

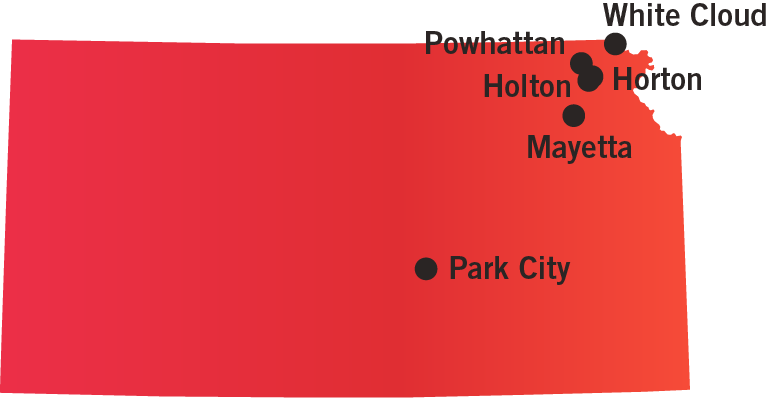

Number of Casinos 4

-

Economic Impact $1.51 Billion

-

Jobs Supported 6,846

-

Tax Impact $237.7 Million

-

Gross Gaming Revenue $588.3 Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

Number of Casinos 7

-

Economic Impact $907.1 Million

-

Jobs Supported 7,078

-

Tax Impact & Tribal Revenue Share $94.0 Million

-

Gross Gaming Revenue $258.1 Million (2016)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

The Kansas Racing and Gaming Commission

700 SW Harrison Street

Suite 500

Topeka, KS 66603

785-296-5800

Website

The Kansas Racing and Gaming Commission (KRGC) is the agency empowered by the Kansas Expanded Lottery Act (KELA) to regulate casino-style gaming, sports betting, and pari-mutuel wagering in Kansas. The KRGC is made up of a board of five commissioners that meet monthly to conduct regulatory business for gaming in Kansas. Each commissioner is appointed by the governor and confirmed by the state legislature to serve a four-year term with the possibility of reappointment.

The KELA also created the Lottery Gaming Facility Review Board (LGFRB) to review applications and determine the “best possible contract” in the four gaming zones. The LGFRB is a subdivision of the Kansas Racing & Gaming Commission. The LGFRB consists of seven members: three appointed by the governor, two appointed by the president of the Kansas Senate, and two appointed by the speaker of the Kansas House of Representatives. The governor chooses which member becomes chairman of the board. Not more than four members of the board shall be members of the same political party. The LGFRB was disbanded in 2011 but was reconstituted in 2014 to review applications for the southeast gaming zone, the last open gaming zone, which was awarded in 2015.

AVAILABLE GAMING LICENSES

Lottery Gaming Facility

Gaming Supplier License

Non-Gaming Supplier License

For more information on available gaming licenses, see Regulatory Fact Sheet.

Tribal gaming commissions, created by the operating tribe, are responsible for licensing and regulating Class III gaming pursuant to tribal-state compacts and tribal law. Currently, four tribes in Kansas operate Class III gaming under compacts with the state:

- Iowa Tribe of Kansas and Nebraska;

- Kickapoo Tribe of Indians of the Kickapoo Reservation in Kansas;

- Prairie Band of Potawatomi Nation, Kansas; and

- Sac and Fox Nation of Missouri in Kansas Nebraska.

The Kansas State Gaming Agency (KSGA) is the state gaming agency responsible for oversight of Class III gaming conducted in Kansas. Among other things, the KSGA may:

- Examine and inspect tribal gaming facilities;

- If allowed under the compact, review any licensing and disciplinary action taken by tribal gaming commissions; and

- Perform all functions and duties required to comply with and ensure tribal compliance with compacts.

The compacts require the KSGA and tribal gaming commissions to meet on a quarterly basis to review past practices and evaluate the best way to regulate the casinos moving forward.

Tribes may enter into management contracts for the operation and management of Class III gaming activities as authorized under IGRA.

The compacts will remain in effect in perpetuity unless deemed invalid, terminated by the mutual consent of the tribes and the state, or a tribe adopts a resolution revoking its authority to conduct Class III gaming.

Under the Compacts, tribes are allowed to conduct Class III gaming on their reservations, but may not conduct pari-mutuel wagering, off-track betting, sports betting, club keno, or state-wide lottery gaming.

AVAILABLE GAMING LICENSES

Management Contractor License

Manufacturer/Distributer License

For more information on available gaming licenses, see Regulatory Fact Sheet.

TAX RATE

The state lottery must receive at least 27 percent of lottery gaming facility revenues. For more information, see Regulatory Fact Sheet.

TAX PROMOTIONAL CREDITS

Promotional credits are tax free.

WITHHOLDINGS ON WINNINGS

5% of the proceeds paid (amount won less the amount bet)

TAX ALLOCATION

Gaming taxes in the state are allocated to fund state debt reduction, infrastructure improvements and property tax relief.

REVENUE SHARE

The tribes do not share any revenue with the state. However, all operating expenses for the KSGA must be paid by tribes from a fund created in the state treasury called the Tribal Gaming Fund.

TAX PROMOTIONAL CREDITS

No

WITHHOLDINGS ON WINNINGS

Yes

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

The problem gambling and addictions grant fund receives 2% of lottery gaming facility revenues.

SELF-EXCLUSION

The Voluntary Exclusion Program offers problem gamblers two options for exclusion: a lifetime ban or a two-year ban.

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

Advertisements shall be based on fact and shall not be false, deceptive or misleading.

All on-site advertisements must comply with the facility’s responsible gaming plan.

ON-PREMISE DISPLAY REQUIREMENT

Any lottery gaming or racetrack gaming facility shall post one or more signs at the location that operates electronic gaming machines or lottery facility games.

AGE RESTRICTIONS

21+ years old to gamble

21+ years old on floor

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

No alcoholic beverages can be served or consumed on any gaming floor. Additionally, no alcohol may be consumed in the gaming floor between the hours of 2 am and 9 am.

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

Persons must be 21 to place any wager, directly or indirectly, on any gaming activity.

OPERATION ON HOLIDAYS

Tribes can operate on holidays.

TESTING REQUIREMENTS

Each machine must be tested and approved by the KRGC.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance regulations.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

None

SHIPPING REQUIREMENTS

KRGC must approve – 15-day notice required.

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

TESTING REQUIREMENTS

All electronic gaming devices must be tested by a gaming test laboratory

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act apply.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

Gaming on credit shall be limited to checks, wire transfers, bank credit cards and bank money machine cards

SMOKING BANS

No.

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrency is not currently accepted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

Legislation enacted in 2022 authorized the state’s four Lottery Gaming Facilities to offer both land-based and mobile wagering, as well as install wagering kiosks at retail partner locations.

Kansas’ Class III tribes are not currently permitted to offer sports betting.

MOBILE/ONLINE

Allowed statewide

TAX RATE

10 percent

INITIAL LICENSING FEE

None

LICENSE RENEWAL FEE

None

AMATEUR RESTRICTIONS

The majority of the participants in wagered events must be no less than 18 years of age.

TAX ON PROMOTIONAL CREDITS

Tax is imposed on all sports wagering revenues received from wagers. Taxable revenue does not explicitly include promotional credits.

AGE RESTRICTIONS

Must be 21 years old.