State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

Number of Casinos 10

-

Economic Impact $711.1 Million

-

Jobs Supported 5,292

-

Tax Impact & Tribal Revenue Share $99.5 Million

-

Gross Gaming Revenue $157.1 Million (2016)

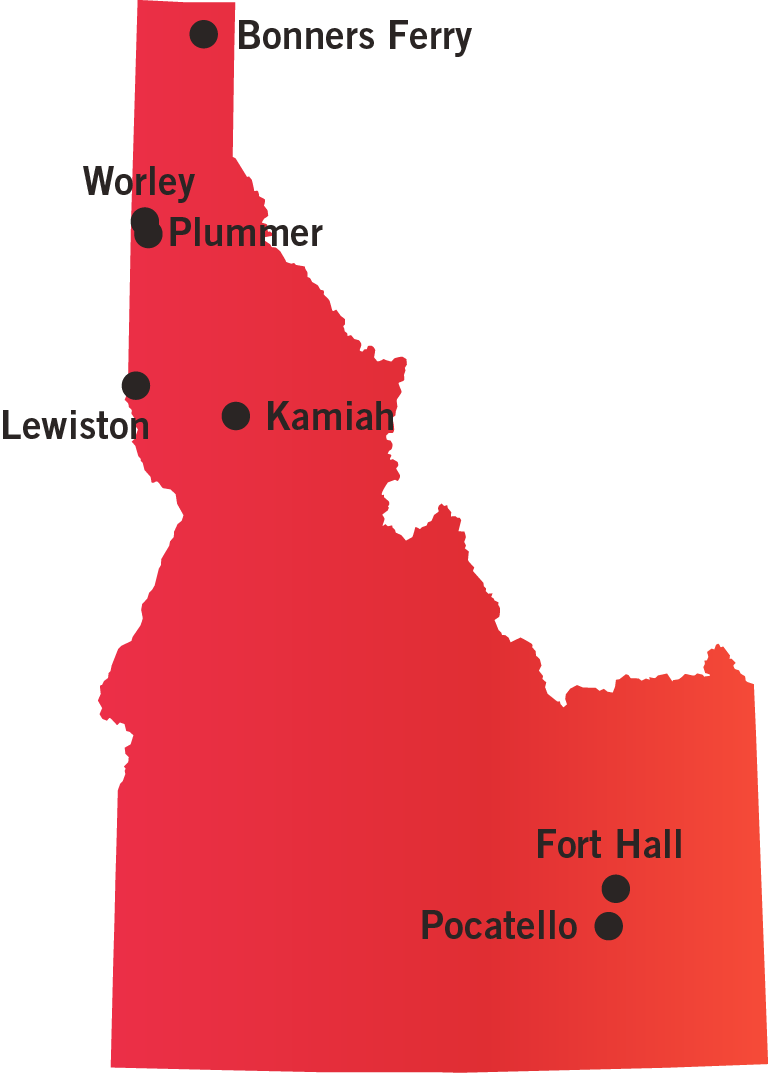

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Idaho has four compacted tribes: the Coeur d’Alene Tribe, the Kootenai Tribe of Idaho, the Nez Perce Tribe, and the Shoshone-Bannock Tribes of the Fort Hall Reservation.

The tribal gaming commission has the primary responsibility for the on-site regulation, control and security of the gaming operation.

The Idaho State Lottery has the limited authority to monitor and inspect the gaming operations to ensure that the gaming operation is conducted in compliance with the compact and applicable regulations.

All four compacts authorize the Idaho State Lottery to operate within the reservations subject to the tribes’ approval. Under the terms of the Nez Perce Compact, Idaho agrees to pay to the Nez Perce Tribe an annual fee equal to 10% of the total annual net sales made by the Idaho State Lottery in the communities and surrounding unincorporated trading areas.

All four compacts remain in perpetuity, unless renegotiated, replaced, or terminated.

AVAILABLE GAMING LICENSES

Manufacturer/Distributor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

REVENUE SHARE

Tribes are not required to share revenue with the state.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

None

STATE USE OF REVENUE

N/A

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

Advertising restrictions are only found in the Shoshone-Bannock tribal-state gaming compact.

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

18 is the minimum age for taking part in gambling at the state’s tribal casinos.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

None

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

No

Cashless Gaming and Alternative Payments

No. Idaho law and regulations do not prohibit specific payment types. Additionally, Idaho does not accept cryptocurrency as a form of payment.

LEGAL SINGLE GAME SPORTS BETTING

Not allowed