State of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

-

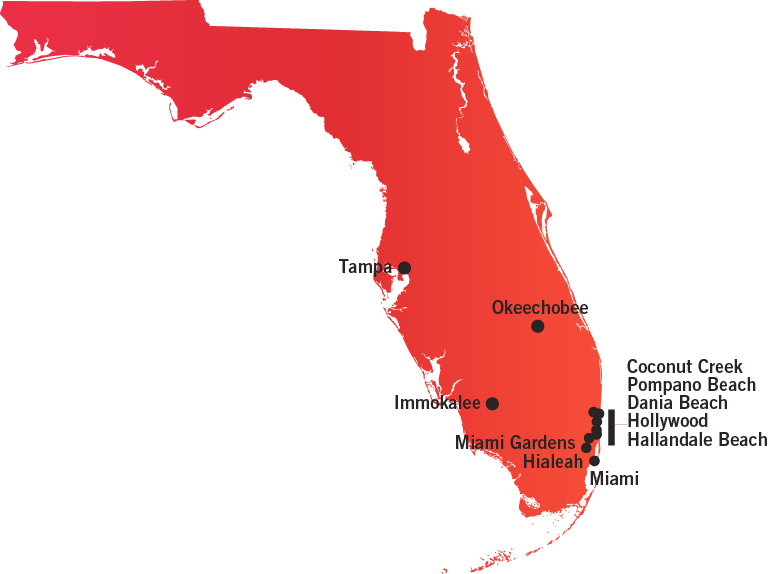

Number of Casinos 15

-

Economic Impact $12.70 Billion

-

Jobs Supported 72,892

-

Tax Impact & Tribal Revenue Share $2.14 Billion

-

Gross Gaming Revenue $690.9Million (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

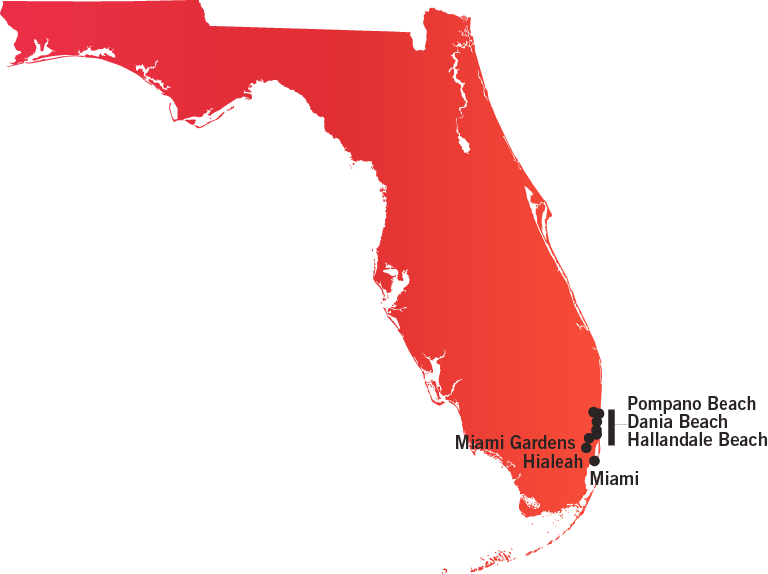

Number of Casinos 8

-

Economic Impact $4.33 Billion

-

Jobs Supported 22,737

-

Tax Impact $706.2 Million

-

Gross Gaming Revenue $690.9Million (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

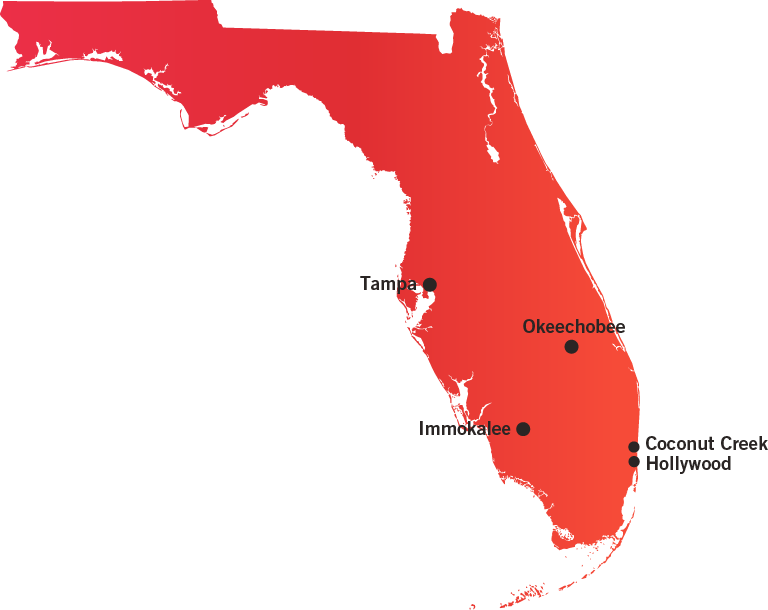

Number of Casinos 7

-

Economic Impact $8.37 Billion

-

Jobs Supported 50,155

-

Tax Impact & Tribal Revenue Share $1.43 Billion

-

Gross Gaming Revenue $2.56 Billion (2016)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Florida Department of Business and Professional Regulation

Division of Pari-Mutuel Wagering

2601 Blair Stone Road

Tallahassee, FL 32399-1035

850-487-1395

Website

The Office of Slot Operations within the Division of Pari-Mutuel Wagering regulates slot machine operations.

The Office of Slot Operations is charged with the oversight of the day-to-day operations at slot facilities, as well as the licensing of individuals and ensuring the integrity of slot machine gaming in the state.

AVAILABLE GAMING LICENSES

Slot Machine Operator License

Business Entity Occupational License

For more information on available gaming licenses, see Regulatory Fact Sheet.

The Seminole Tribe of Florida is the only tribe in the state of Florida authorized to offer Class III gaming.

The Seminole Tribal Gaming Commission is primarily responsible for carrying out the tribe’s regulatory responsibilities under the tribal gaming ordinance, the compact, and the Indian Gaming Regulatory Act (the IGRA).

The Governor’s Office in Florida provides oversight of Indian casinos through the state compliance agency (SCA). The compact agreements stipulate that the SCA has the authority to ensure games are conducted in compliance with compact provisions. The SCA can be any agency which the Florida legislature has designated for this purpose. Under the latest compact, the Division of Pari-Mutuel Wagering has been appointed with state oversight.

The Seminole compact terminates in 2030; however, some of its provisions authorizing the tribe to offer specific games terminated in 2015.

AVAILABLE GAMING LICENSES

Supplier of Gaming Goods or Services License

For more information on available gaming licenses, see Regulatory Fact Sheet.

GAMING TAX RATE

There is a 35 percent slot machine tax.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

None

TAX ALLOCATION

Slot machine tax is distributed to the Educational Enhancement Trust Fund of the Department of Education.

EXCLUSIVITY FEE

In May 2019, the Seminole Tribe ceased payments to the state for violation of the tribal-state gaming compact. Until the state and the tribe reach a new agreement over certain card game exclusivity, the tribe will no longer make payments.

TAX PROMOTIONAL CREDITS

None.

WITHHOLDINGS ON WINNINGS

None.

STATE USE OF REVENUE

None.

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

Slot machine facilities are required to pay an annual “compulsive or addictive gambling prevention program fee” of $250,000.

SELF-EXCLUSION

Yes

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

Each slot machine gaming licensee must establish a responsible gaming advertising program.

ON-PREMISE DISPLAY REQUIREMENT

Required for slot machine gaming licenses

AGE RESTRICTIONS

21+ years of age to gamble

21+ years of age on floor

STATUTORY FUNDING REQUIREMENT

No less than $250,000 per facility annually

SELF-EXCLUSION

Patrons may self-exclude for a minimum of one year, five years, or a lifetime.

COMPLIMENTARY ALCOHOLIC DRINKS

None

ADVERTISING RESTRICTIONS

Advertising and marketing must contain a responsible gambling message and a toll-free helpline number for problem gamblers.

ON-PREMISE DISPLAY REQUIREMENT

Signs bearing a toll-free helpline number and educational and informational materials must be made available at conspicuous locations.

AGE RESTRICTIONS

The Seminole Tribe have instituted a policy that prohibits individuals under 18 years of age from taking part in live poker or bingo. An additional policy is in place that restricts individuals under 21 years of age from participating in any other form of casino gaming.

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

Must be approved by a licensed independent testing laboratory.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance regulations.

SHIPPING REQUIREMENTS

Must be formally approved by state, and requires state employee to be present for delivery.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

Yes

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Florida gaming laws and regulations allow for slot machine games to include electronic payment systems, except a credit card and debit card. Additionally, Florida does not accept cryptocurrency as a form of payment.

TESTING REQUIREMENTS

Yes

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act apply.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

Yes

SMOKING BANS

Yes.

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. Electronic payment systems are permitted for slot machine games. Additionally, Florida does not accept cryptocurrency as a form of payment.

AUTHORIZED OPERATORS

The Seminole Tribe of Florida

MOBILE/ONLINE

Allowed statewide

TAX RATE

Retail: 13.75%

Online: 10%

INITIAL LICENSING FEE

Licensing regulations have not been announced by the Tribe.

LICENSE RENEWAL FEE

N/A

AMATEUR RESTRICTIONS

Wagering on the following types of events are prohibited:

- Bets on youth sports.

- Proposition bets on college sports.

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.